Forget the 60/40 Rule—It’s Time to Rethink Asset Allocation

Jun 09, 2025

As people get closer to retirement, one of the biggest questions they begin to ask is, “How should my money be invested?” In financial planning terms, this is known as asset allocation. At its core, it’s about deciding how much of your portfolio should be in stocks, and how much should be in fixed-income investments like bonds, CDs, or treasuries.

In the retirement planning world, this decision is often simplified into a few familiar ratios. A 50/50 asset allocation means half in stocks and half in fixed income. A 60/40 mix is even more common, where 60% is in stocks and 40% in fixed income. And if you're a little more aggressive, you might hear someone suggest a 70/30 split.

Like most financial rules of thumb, these ratios can serve as a helpful starting point, but they often fall short when it comes to building a portfolio that actually fits your needs. In many cases, this approach is more about efficiently managing large numbers of clients than it is about building the right strategy for one individual. It’s much easier for a big firm to assign someone an allocation based on their age or their answers to a risk questionnaire than it is to create something thoughtful and personalized. That doesn’t mean these mixes are always wrong. But they’re certainly not always right either.

What’s often missing is a deeper understanding of the two elements that should drive your investment allocation: risk capacity and risk tolerance.

Asset Allocation Step 1: Determine Your Risk Capacity

Before choosing an investment mix, start with the math. The first and most important question is: How much risk can your retirement plan afford to take without putting your future income needs at risk?

This is your risk capacity, and it's the foundation of a solid investment strategy. Unlike risk tolerance, which is emotional, risk capacity is objective. It depends on the numbers: your income sources, projected withdrawals, and desired lifestyle.

Once you’ve mapped those out, the next step is to identify how much of your portfolio needs to be set aside for near-term distributions. This portion becomes your spending bucket, a key piece of your plan designed to help reduce the risk of having to sell volatile investments during a market downturn. In other words, it’s your first line of defense against sequence of returns risk.

The Five-Year Liquidity Ladder

At our firm, we think you should hold at least five years' worth of planned withdrawals in stable, low-volatility assets such as bonds, CDs, or short-term treasuries. These are the funds you'd rely on to fund your retirement income, regardless of what the stock market is doing.

Why five years? Because that time frame covers the vast majority of market recoveries.

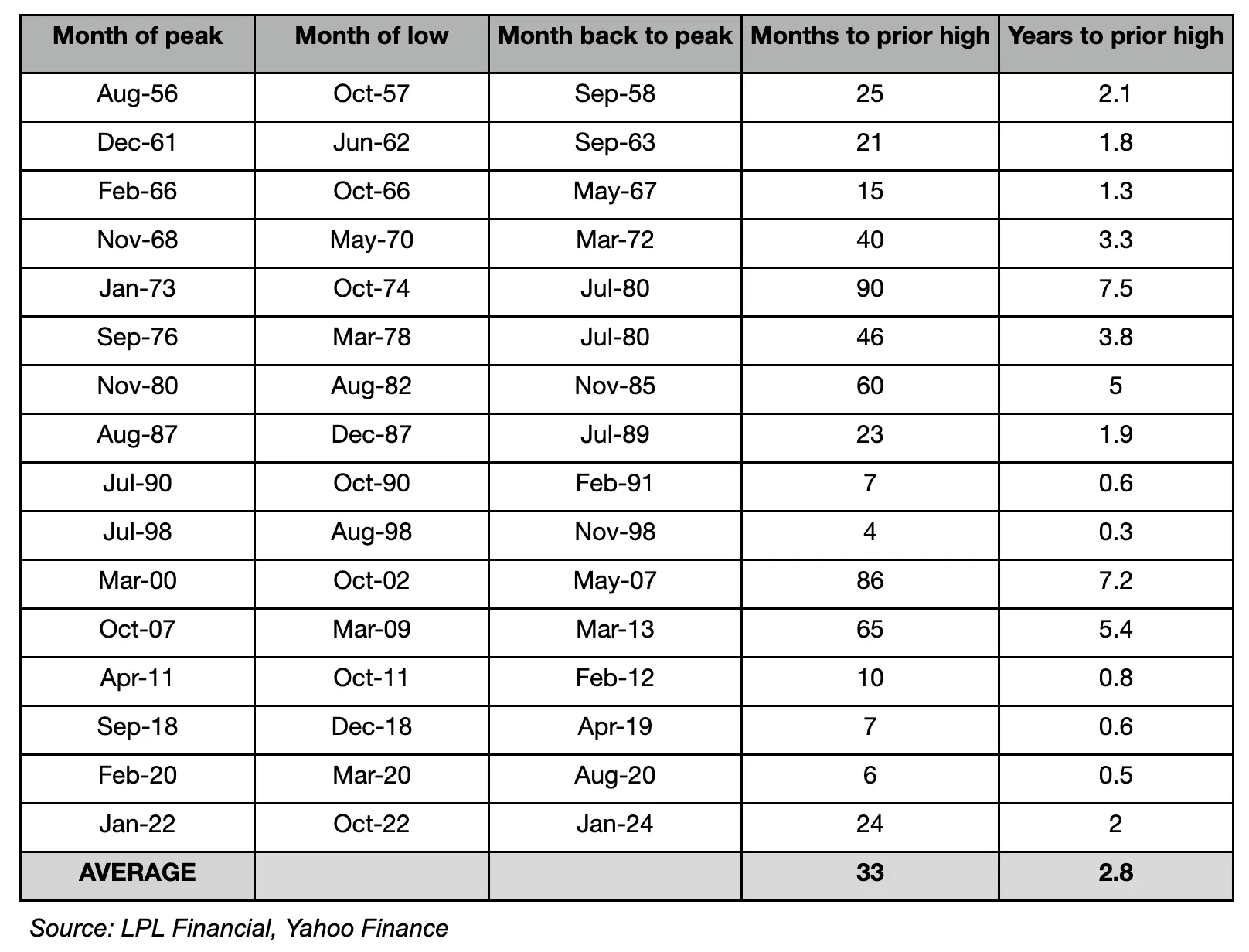

Looking back to 1950, the average time from market peak to full recovery is about 33 months, or 2.8 years. While there have been a few exceptions, five years has generally proven to be a durable buffer.

Here’s a summary of historical recovery periods:

By setting aside enough stable assets to fund at least five years of retirement spending, you create a cushion that helps you avoid panic-selling stocks during a downturn. This approach gives you the time and flexibility to let riskier investments recover while still meeting your day-to-day needs.

By setting aside enough stable assets to fund at least five years of retirement spending, you create a cushion that helps you avoid panic-selling stocks during a downturn. This approach gives you the time and flexibility to let riskier investments recover while still meeting your day-to-day needs.

Asset Allocation Step 2: Determine Your Risk Tolerance

Once you’ve determined the minimum amount of fixed income your plan requires, the next step becomes more personal: understanding your risk tolerance.

This isn’t about numbers on a spreadsheet. It’s about how you feel when the market drops. I call this your “freak out number.” That term comes from my experience during the 2008–2009 financial crisis. I saw firsthand how even the most sensible allocation can fall apart if the investor can’t emotionally stay the course. It’s critical to test for this because reactionary selling during a downturn is one of the most damaging things you can do to a retirement plan.

Risk tolerance is behavioral. Two people with identical retirement plans might have entirely different thresholds for discomfort. One might sleep soundly with 70% in stocks. Another might panic if their portfolio drops 40%.

That’s why I walk people through an exercise that puts hypothetical losses into real-dollar terms—not vague percentages. Because while a “20% decline” may sound routine, it feels very different when you’re looking at a $400,000 drop on a $2 million portfolio.

The Two-Stage Risk Conversation

Here’s how the conversation usually unfolds:

Advisor: “Mr./Mrs. Client, your portfolio is currently worth $2 million. The market takes a quick hit. You haven’t heard from us yet. You log in and see your balance is down by $200,000. That’s 10%. How do you feel?”

Client: “That’s not too bad.”

Advisor: “What if it’s down $400,000—20%? Would you want to talk?”

Client: “Yes, I’d definitely want a call.”

That’s the reassurance number. You'd want to talk about it, but you probably wouldn't abandon your plan.

Then we take it further:

Advisor: “What about a $600,000 drop—30%? Would you still feel comfortable staying invested?”

Almost no one says they would sell at this point, especially if I recommend holding. But it starts to feel more real.

Advisor: “What if your portfolio is down $800,000—40%?”

This is usually when the tone changes. In couples, one spouse might start wavering while the other holds firm.

Advisor: “And what if your portfolio drops by $1 million—50%? Half of everything you’ve saved.”

This is often the breaking point. About half of people will say, “That’s my limit.”

This is the freak out number. It is the point where emotion takes over, and no amount of logic, planning, or reassurance is likely to stop you from wanting to sell.

The other half insist they would stay the course through a 50 percent decline. At that point, it becomes much harder to identify a clear breaking point. If someone says they could remain invested through that level of loss, we generally assume they have a very high risk tolerance. And to be fair, some people truly do. They lived through both the 2000 to 2002 downturn and the 2008 to 2009 financial crisis. Those experiences strengthened their resolve to stay invested, no matter what.

Aligning Your Portfolio to Your Freak Out Number

Once you’ve identified your freak out number, you can reverse-engineer your portfolio to stay within that boundary using historical drawdown data as your guide. The idea is to build an allocation that never exposes you to more downside than you can emotionally handle.

Here’s how that might look in practical terms:

-

If your freak out number is –40%, a 100% stock portfolio is off the table.

-

If it’s –30%, equity exposure may need to be capped around 50%.

-

If it’s –20%, stock exposure may need to stay below 40%.

The goal isn’t to eliminate risk entirely. It’s to stay within emotional and financial boundaries, so that when the market drops, as it inevitably will, you can stay invested and stick to your plan.

Here's a quick summary showing the largest peak to trough declines for various asset allocation models:

Risk Capacity Sets the Floor. Risk Tolerance Sets the Ceiling.

Once you’ve defined both your risk capacity and your risk tolerance, the next step is combining them to determine your actual asset allocation.

Start with your risk capacity. This is the minimum amount of fixed income your plan needs in order to function safely. In most cases, that means setting aside at least five years' worth of planned retirement withdrawals in low-volatility assets like bonds, CDs, or short-term treasuries. This becomes your floor. It is the portion of your portfolio that must remain stable to protect your income during market downturns.

Then consider your risk tolerance. This is about how much market volatility you can emotionally handle. It is based on your freak out number—the amount of loss that would make you want to exit the market.

Now here’s how these two pieces come together:

If your risk capacity tells you that 20 percent in fixed income is enough to meet your spending needs, that becomes your floor. But if your risk tolerance indicates that you are only comfortable with 60 percent in stocks, then you need 40 percent in fixed income to feel at ease. In this case, your final allocation would likely be 60 percent stocks and 40 percent fixed income. Not because your plan demands that level of safety, but because your comfort level does.

This is how the two work together. Risk capacity sets the minimum amount of fixed income needed to keep your plan on track. Risk tolerance sets the maximum amount of risk you can handle without losing confidence and making a decision that could harm your plan.

Your risk capacity protects your future income. Your risk tolerance protects your peace of mind. The right asset allocation does both.

Why This Two-Step Asset Allocation Process Matters

You might be wondering, "If I’m going to allocate my portfolio based on my risk tolerance anyway, why should I worry about my risk capacity?"

It’s a fair question, and the answer is important.

You must respect both, but you can only stretch as far as the more conservative of the two allows.

If your emotions say you can handle 90% in stocks, but your plan shows you need 30% in fixed income to safely fund five years of retirement spending, then 90% stocks isn’t an option.

On the other hand, if your plan could withstand 80% in stocks but you’d lose sleep with more than 40%, that emotional limit becomes your ceiling.

Risk capacity sets the floor for the minimum fixed income. Risk tolerance sets the ceiling for the maximum allocation to stocks.

Your final asset allocation should always be safe enough to protect your plan, and stable enough to protect your peace of mind.

This two-step process doesn't just give you a number...it gives you a why. And in volatile markets, that’s what keeps you grounded.

Your Asset Allocation Should Be Built, Not Assumed

At Carroll Advisory Group, we believe that your investment allocation should be custom-built—not copied from a chart. We combine math and mindset, planning and psychology, capacity and tolerance to arrive at a mix that works for you.

Because the best allocation isn’t the one that looks perfect on paper. It’s the one you can actually stick with when the next bear market hits.

If you’re ready to build a retirement plan you can trust, one that’s grounded in both logic and emotion, we’d love to help. Schedule a free Retirement Clarity meeting to see how we can help you align your investments with your goals, your comfort level, and your long-term success.