The Free Retirement Budget Calculator Every Retiree Needs

Oct 15, 2025

Your retirement plan is only as strong as your budget, and that’s why a Retirement Budget Calculator is essential. If you retire without a clear, data-driven way to estimate your monthly spending needs, your plan can quickly go off track. I believe this single step of creating a retirement budget is the foundation of every successful income plan. That’s why I built a brand-new, completely free Retirement Budget Calculator to help you pinpoint exactly what you’ll need in retirement.

At some point in early retirement, you’ll make a major shift from saving money to spending the money you’ve saved. If you’ve already gone through this transition, you know how uncomfortable it can feel. For those who are still approaching it, let me warn you: it can create a lot of anxiety. This isn’t something that should happen without a clearly defined retirement income plan.

At the very center of that plan is your retirement budget. Without knowing what you need on a monthly basis after taxes, there’s no reliable way to build an income strategy that works. Before making decisions about Social Security, pensions, withdrawal order, or Roth conversions, you first have to determine your monthly net income goal.

That’s why I created the Retirement Budget Calculator. I believe this step is so important that I invested several thousand dollars with my software developer to make this tool available to everyone for free. I’ll link it below, but before you dive in, let me walk you through exactly how the newest version works and how it can help you plan with confidence.

How to Use the Retirement Budget Calculator

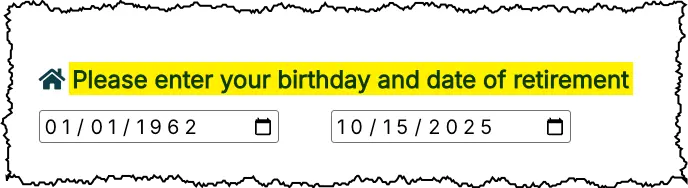

You’ll want to enter your date of birth and your planned retirement date. That may feel a little personal, so if you prefer not to use your exact date of birth, you can enter one that’s close, such as a different day of the same month. It will have the same effect. These dates are important because one of the biggest new features of the Retirement Budget Calculator is the ability to set beginning and ending dates for specific expenses, and that feature won’t work without them.

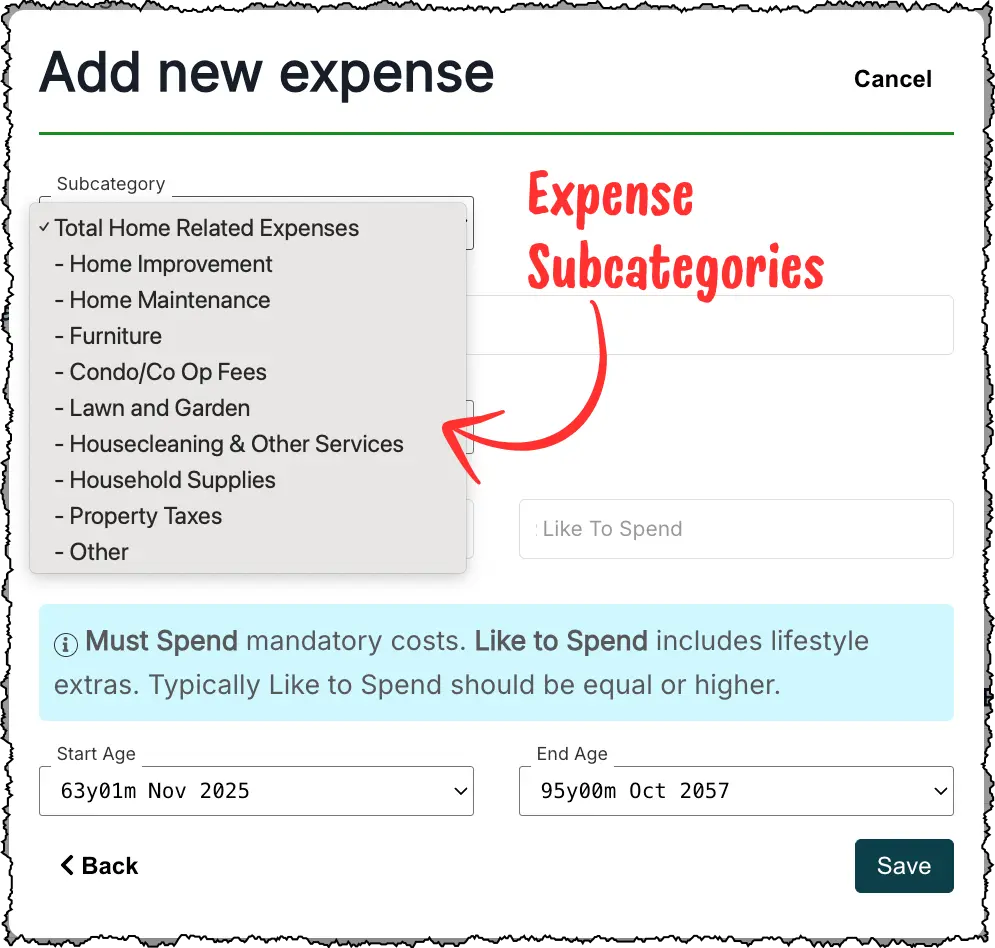

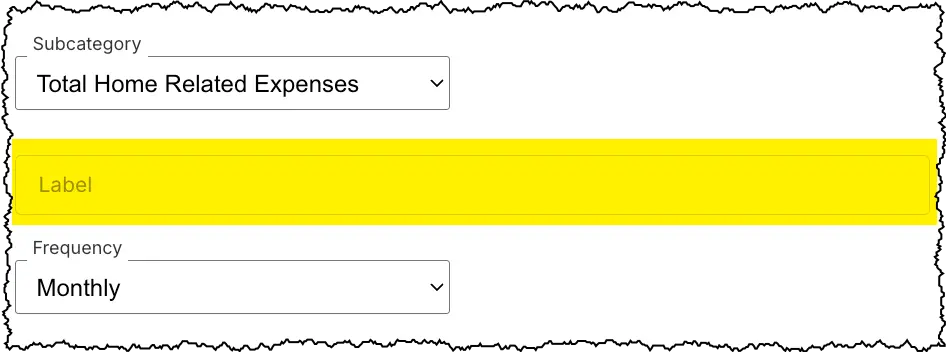

As you scroll down, you’ll see multiple categories of expenses such as Home Related, Utilities, and Communication Services. Within each of these, there are several subcategories for anyone who wants to get more specific with their budgeting. When you click the Add Expense button, for example under the Home Related category, you’ll see a Subcategory box appear. If you prefer to keep things simple, you can select Total Home Related Expenses and enter one combined number. If you want more detail, you can choose one of the individual expense types listed below and break out each cost separately.

The Label box is useful if you want to identify certain expenses with your own nickname. This can be especially helpful when you have more than one expense within the same subcategory. For example, if you have multiple expenses that all belong under Lawn and Garden, you can use the label section to give each one a unique name and keep them separate.

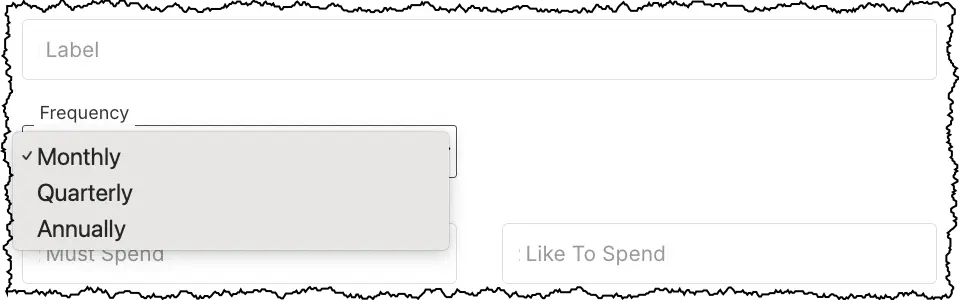

Next, you’ll select the frequency of the expense. Since not all expenses are charged monthly, this feature saves you from having to manually calculate a monthly amount. It’s important to know that the calculator ultimately converts everything to a monthly number. For example, if you enter an annual expense, the output will automatically divide that total by twelve to display it as a monthly amount.

Up next is the section for Must Spend and Like to Spend expenses. This part helps you separate the essential costs that have to be covered each month from the more flexible or discretionary ones. Your Must Spend items include things like housing, insurance, and groceries. These are the expenses that keep your lifestyle running. The Like to Spend section is where you can add the things that make retirement more enjoyable, such as travel, hobbies, and dining out.

The Like to Spend amount should always be higher since it represents your extra or discretionary spending. If you choose not to enter a separate Like to Spend amount, the calculator will automatically use the same value you entered for Must Spend.

Below that is another new feature of the Retirement Budget Calculator, which is the ability to set start and end dates for each expense. Many retirement expenses are time bound, whether that is a mortgage payment, travel budget, or another cost that only lasts for a certain period. Now you can easily specify how long each expense should continue.

By default, every expense is set to run through age 95, but you can change this to match your plans. For example, in the Lawn Care section, let’s say you plan to move to a patio home at age 75 where lawn maintenance is included. You would not want this expense to continue through age 95, so you can simply select the age when the expense should stop.

Once you have entered all the details, click Save, and it will be added to your expense list.

One of the things you’ll notice is that at the bottom of the screen, in the hovering bar, the calculator begins to display your average monthly budget in both the Must Spend and Like to Spend categories. The number shown here is not averaged over your entire retirement. It only reflects the monthly expenses you have entered so far.

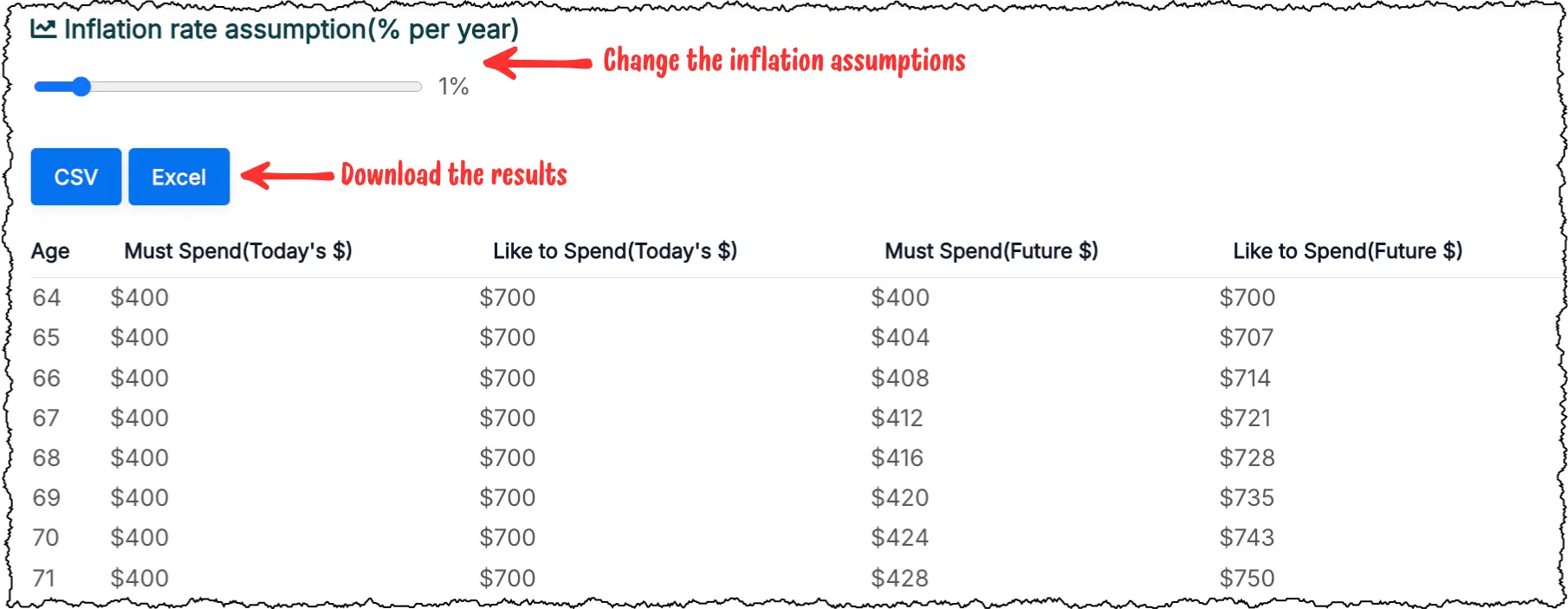

If you want to see how your expenses change over time, you can do that in the section at the bottom. Here, you can adjust the rate of inflation to match your expectations. In the table below, you’ll see Must Spend and Like to Spend columns in today’s dollars, along with Must Spend and Like to Spend columns in future dollars based on the inflation rate you entered. As you move down the table, you can watch how inflation gradually changes your expenses over time.

You’ll also notice that all of these expenses are calculated as monthly amounts. We could have displayed them annually, but since most people plan and track their spending monthly, we kept it that way. If you’d like to download this table for your records or to use it in another spreadsheet, you can do that easily using one of the download options provided.

Creating a clear and realistic retirement budget is one of the most important steps you can take before leaving the workforce. Your investments, withdrawal strategy, and even your Social Security timing all depend on knowing how much income you actually need each month.

Whether you want to keep things simple with a few broad expense categories or get detailed down to specific spending timelines, this tool gives you the flexibility to design a plan that fits your life. It helps you see not only what your expenses look like today but also how they will change over time as inflation and life events take effect.

If you have not already, take a few minutes to try the Retirement Budget Calculator for yourself. It is completely free, easy to use, and could be the missing link between where your retirement plan stands today and the confidence you want to feel about your future.

Access the calculator here https://www.carrolladvisory.com/budget-calculator