The Retirement Tax Sweet Spot: Use It or Lose It

Jan 26, 2026

There’s a powerful retirement planning opportunity that I see many retirees miss.

It’s not a secret investment strategy. It’s not a loophole. And it has nothing to do with trying to beat the market.

It’s a window of time. I call it the Golden Runway.

For some people, this window lasts 10 to 15 years or more. For others, it’s shorter. But regardless of how long it lasts, it is one of the most valuable planning periods in your entire retirement. And once it closes, you don’t get a do-over.

What Is the Golden Runway?

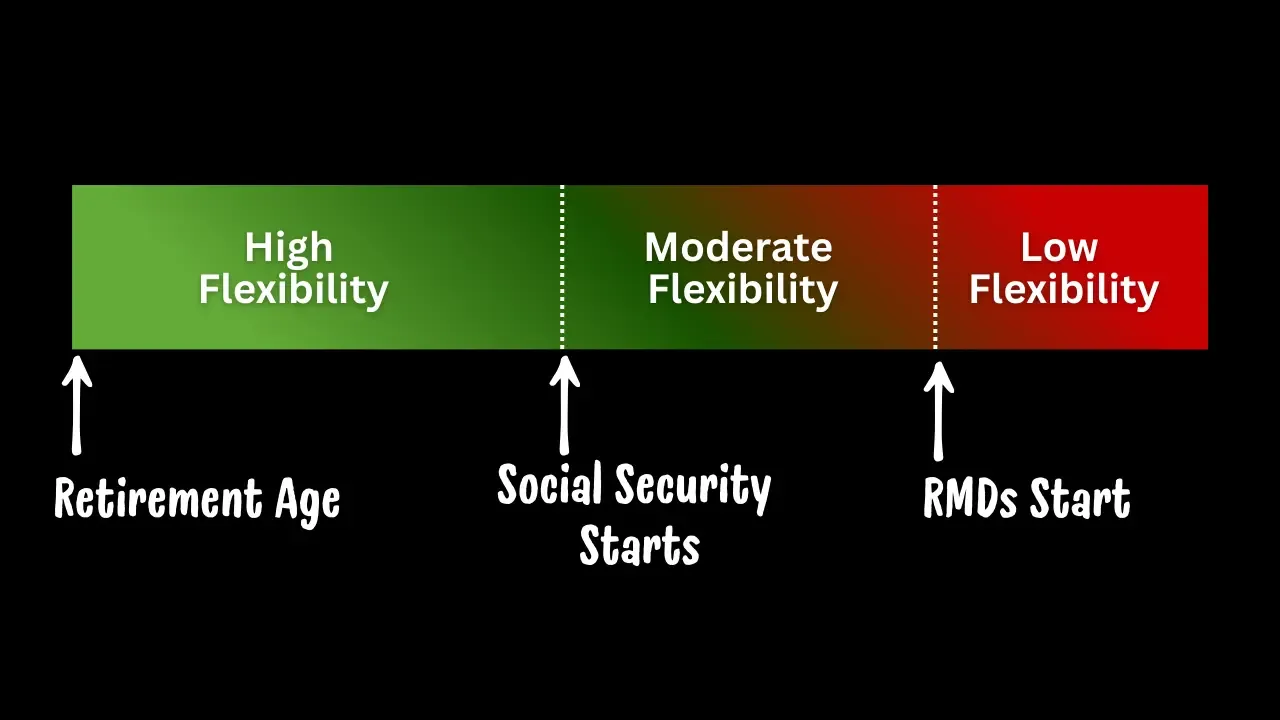

The Golden Runway is the period of retirement after you stop working but before the IRS and Social Security take over your income decisions.

During this time, you often have lower taxable income and more control than you will at any other point in retirement. That combination creates opportunities that simply don’t exist later.

To understand why this window is so important, it helps to think about it in two distinct phases.

Phase One: Retired, But Not Yet Taking Social Security

The first phase typically begins when you retire and ends when Social Security starts.

For many retirees, this is when taxable income is at its lowest. You no longer have wages, but you also don’t yet have Social Security or required minimum distributions pushing income onto your tax return.

This is often the most flexible period of your retirement.

During this phase, strategies like Roth conversions, capital gains harvesting, and tax bracket management can be used intentionally and proactively. You can choose how much income to recognize and when, instead of reacting to whatever shows up on your tax return.

This is where a lot of long-term tax damage can either be prevented or quietly locked in.

Phase Two: Social Security Starts, Flexibility Narrows

Once Social Security begins, you’re still in the Golden Runway, but the rules change.

Because of how Social Security is taxed, additional income can have a ripple effect. A dollar of Roth conversion or capital gain doesn’t always show up as just one dollar of taxable income. It can cause more of your Social Security benefit to become taxable as well.

That doesn’t mean planning stops. It just means decisions need to be more deliberate.

You still have opportunities, but the margin for error gets smaller.

When the Window Closes

Eventually, required minimum distributions enter the picture.

At that point, the IRS is forcing taxable income on you whether you need it or not. Your ability to shape your tax picture is dramatically reduced. Most of the big decisions are already behind you.

This is the point where I often hear some version of,

“Devin, I wish I’d paid more attention to this earlier.”

And I understand why it happens.

Why So Many Retirees Miss This Opportunity

In the early years of retirement, life is good.

You’re traveling. Spending time with family. Checking off bucket list items. Enjoying the freedom you worked decades to earn. The last thing most people want to do during this phase is open a tax-planning spreadsheet.

So this window quietly slips by.

Not because people are careless or irresponsible. But because life is finally happening.

The problem is that taxes don’t stop just because you’re enjoying retirement. Decisions made during these early years echo for the next 20 or 30.

The Cost of Doing Nothing

Missing the Golden Runway doesn’t usually cause immediate pain. That’s what makes it so dangerous.

The impact shows up later as higher lifetime taxes, increased Medicare premiums, fewer Roth dollars, and less flexibility when you need it most.

It often comes with that sinking feeling at 75 of realizing the best window you had is already behind you.

The good news is that taking advantage of this window doesn’t require turning retirement into a second job.

How to Make the Most of Your Golden Runway

If you’re in or approaching this period, there are two solid paths forward.

Option 1: Use the Right Planning Tools

You can get comfortable with a retirement planning tool like Boldin, or another advanced platform that goes beyond basic projections.

Not something that just shows a pie chart and a green checkmark. But software that lets you test real strategies like Roth conversions, capital gains harvesting, tax bracket management, and Social Security timing.

That’s where the real opportunities live.

If you want to explore that route, you can learn more about Boldin here:

👉 https://go.boldin.com/DevinCarroll

Option 2: Work With a Planner Who Actually Plans

If software isn’t your thing, the alternative is to work with a financial planner who genuinely prioritizes planning.

Not “planning lite.” Not a generic report used as a sales tool. But someone who treats planning as the point, not just a means to gather assets.

That planner doesn’t have to be me or my firm. But it should be someone who understands how critical this window is and knows how to use it intentionally.

This Is a Use-It-or-Lose-It Window

The Golden Runway is your chance to set the foundation for the rest of your retirement, while the decisions are still yours to make.

Once it’s gone, the options narrow. The taxes rise. And flexibility fades.

If you’re curious whether you’re making the most of your own Golden Runway, you can schedule a conversation with me directly.

No pressure. Just clarity.

Because this is one retirement opportunity you don’t want to look back on and wish you’d used.