The Myth of Social Security’s 8% Guaranteed Return

Nov 03, 2025

You have probably heard it before: “Delaying Social Security gives you an 8% guaranteed return.” It sounds incredible in a world where most retirees are balancing market risk, rising costs, and uncertain longevity. Here is the truth: that 8% number does not mean what most people think it means. It is not a return.

- Myth: Delaying benefits gives you an 8% investment return.

- Fact: The 8% is a benefit increase, not a return on investment.

Why an 8% Benefit Increase is not an 8% Return

Consider a person with a full retirement age benefit of $3,000 per month.

| Filing Age | Monthly Benefit | Notes |

|---|---|---|

| 62 | $2,100 | Early filing reduction |

| 67 (FRA) | $3,000 | Full benefit |

| 70 | $3,720 | Delayed retirement credits |

Waiting from 62 to 70 means giving up $25,200 per year for eight years, about $201,600 in total missed payments, in exchange for an extra $19,440 per year for life once benefits start. Whether that trade looks good depends on how long you live.

The Real Math: Internal Rate of Return (IRR)

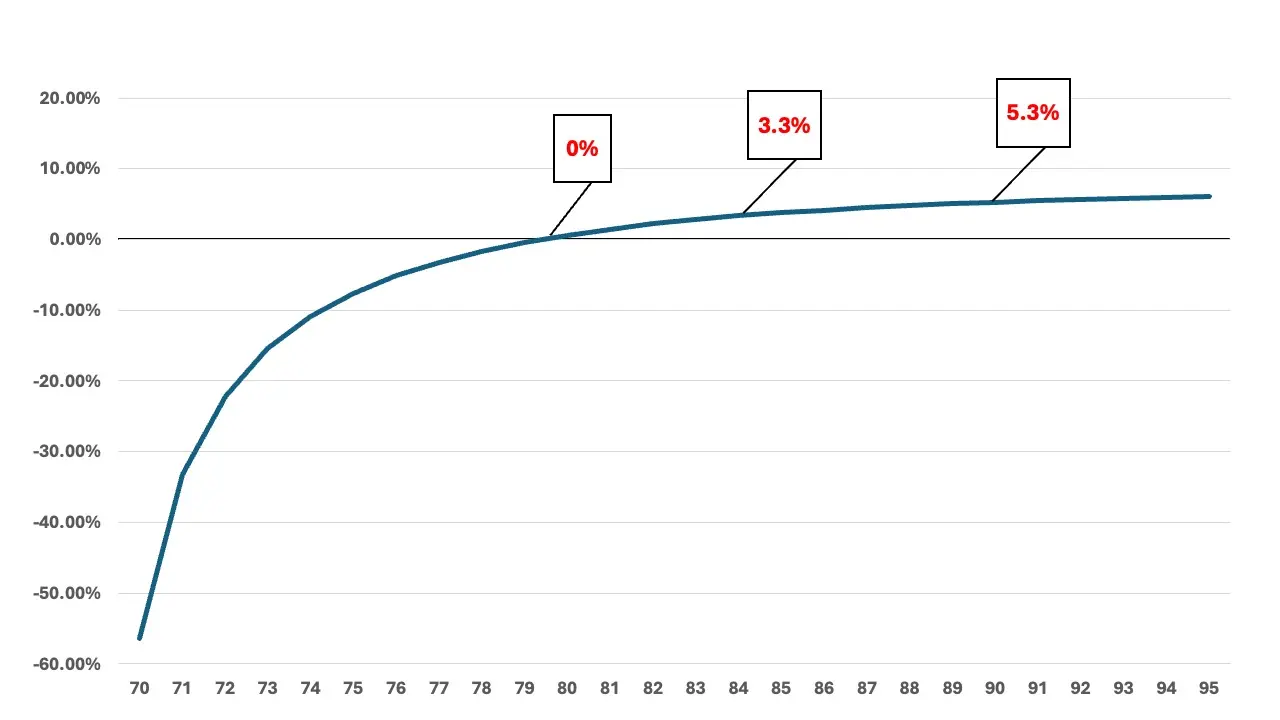

IRR is the rate that makes the value of missed payments equal the value of higher future payments. It answers the simple question: if delaying Social Security were an investment, what annual return would that decision earn?

- IRR is negative until about age 79½.

- By age 84 (life expectancy for a 62-year-old today), IRR is about 3.3%.

- By age 90, IRR is roughly 5.3%.

Why This Still Matters

Delaying does not give you an 8% return. Even so, a steady 3% to 5% return that is backed by the U.S. government and not tied to market swings is valuable. There is no volatility, no interest rate risk, and no chance of outliving this income. The key is longevity. The longer you live, the better the trade looks.

The Bigger Picture: When Delaying Makes or Does Not Make Sense

- Health and longevity expectations: If health is poor, the breakeven age may not be realistic.

- Spousal coordination: A higher earner who delays can increase a survivor benefit for a spouse.

- Income needs and taxes: Claiming early can preserve investments in some cases, especially in low-income gap years before RMDs.

- Market returns: Strong portfolio growth can favor claiming later. During market declines, starting Social Security can reduce portfolio withdrawals.

The real benefit of delaying Social Security is not an 8% guaranteed return. It is greater lifetime income and protection against longevity risk. When you hear “8% return,” remember that it refers to an increase in a guaranteed income stream, not a market yield.