The Roth Conversion Tax Break Even

Jan 05, 2026

There’s one chart you need to see if you’re thinking about a Roth conversion. It shows you when the taxes you’ve paid finally start saving you money.

It’s called the break-even point. And if you haven’t seen this visual before, it might completely change how you think about Roth conversions.

What Is the Break-Even Point and Why Does It Matter?

Managing taxes in retirement is one of the biggest reasons we plan in the first place. But unfortunately, not enough attention is given to the taxes along the way. For example, think about the most common approach to Roth conversions. A lot of people:

- Aim to fill up the 12% or 22% tax bracket each year before their Required Minimum Distributions (RMDs) begin

- Or stop converting once they hit a certain IRMAA threshold.

And honestly, I understand why. That approach is simple, logical, and feels like a smart way to stay efficient year by year.

But let’s call it what it is: short-term tax management. It focuses on minimizing this year’s tax bill, not building a long-term strategy. It’s tactical, not strategic. And it can miss opportunities, or create future problems, by ignoring how today’s decisions play out over the next 10 to 20 years.

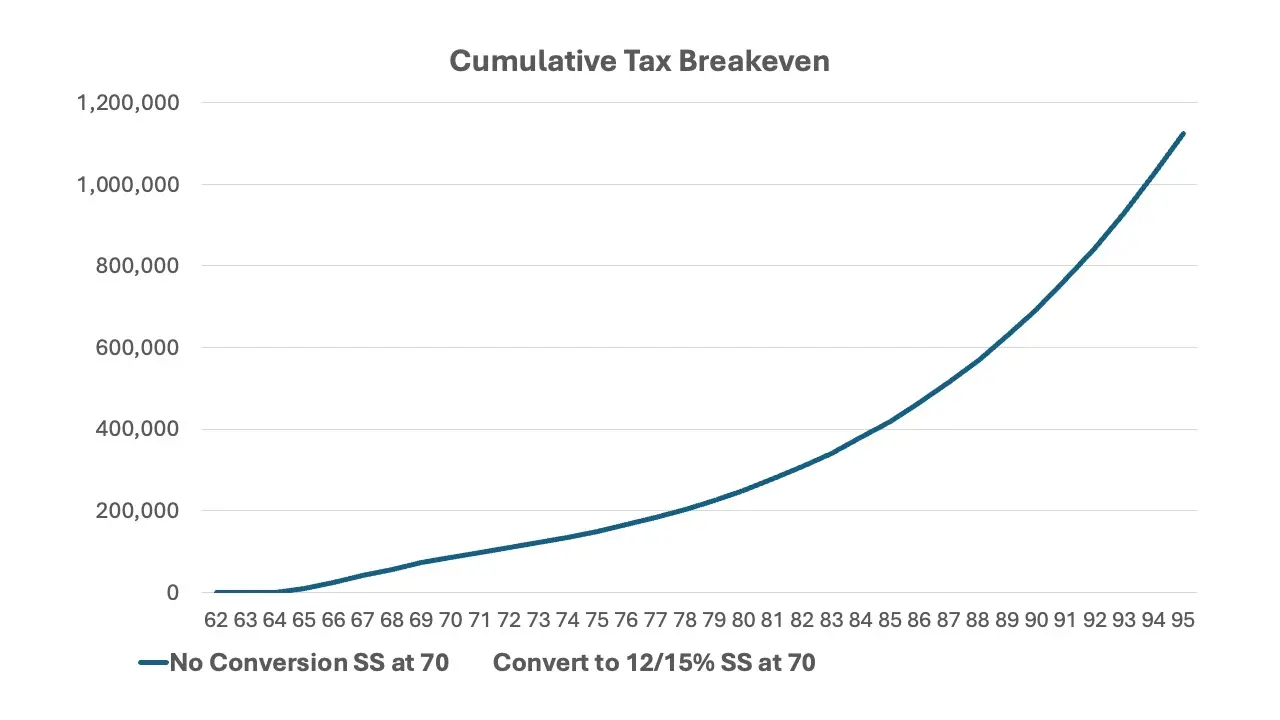

What a Roth Break-Even Chart Tells You

One of my favorite ways to illustrate the long-term impact of Roth conversions is with a simple break-even chart that compares cumulative taxes between doing a conversion and not doing a conversion. It’s a powerful visual that shows not just if a conversion saves you money, but when it does. That timing can make all the difference in how you feel about the tradeoff.

Now, I’ll say two things right up front:

1. You cannot use this chart in isolation. Like any break-even analysis, this is a valuable piece of data to consider when making a comprehensive decision, but it certainly can’t be the ONLY thing you use.

2. A tax break-even analysis is only useful if you're converting with the goal of reducing taxes over your life expectancy.

If you’re doing Roth conversions because you think tax rates will rise, or you want to leave a more efficient inheritance to a spouse or children, then this lens doesn’t apply as directly. But since most people pursue Roth conversions to reduce lifetime taxes, this has pretty wide application.

Example

Let's look at this couple. They’re both 62 and recently retired. They have:

- $1 million in pretax IRAs

- $300,000 in a taxable account (with a $200,000 cost basis)

- Together, their full retirement age Social Security benefit is $5,000 per month

They need $8,000 in net income per month and want to plan through age 95. This couple has all the key ingredients to strongly consider Roth conversions: a relatively low monthly income need and money saved in a taxable brokerage account.

The Problem with Most Financial Software

To integrate all the moving parts, it’s almost impossible not to use software. But that software has limitations. One of my biggest complaints is how financial planning software tends to obsess over the finish line, what plan gives you the most in assets and the least in taxes at the end of the plan.

For example, when I plug this couple into our financial planning software, here’s what it tells me

- Compared to not converting at all, converting to the top of the 10% bracket results in just over $590,000 in additional tax-adjusted ending assets and saves $285,078 in lifetime taxes.

- If we increase the conversion to the 12% bracket, the ending balance is $473,000 higher, but lifetime tax savings increase to $726,879.

But again, that’s using the end-of-plan value as the measure of success. And that’s not the right way to look at it, because financial planning isn’t just about what you die with. It’s about how your decisions impact your life along the way.

A strategy that looks great at age 95 might still come with years of unnecessary tax drag or missed opportunities along the way. That’s why we need to look at when the tax savings show up, not just how big the number is at the end. That’s why I like to use a break-even chart in the plans we create.

When the Saving Starts

The first step in building a tax break-even view is to start with what they would pay if they did no Roth conversions, and then compare that to a few different conversion scenarios.

This line shows cumulative taxes if they did no Roth conversions. It starts modestly, but once RMDs kick in, you’ll see a sharp increase.

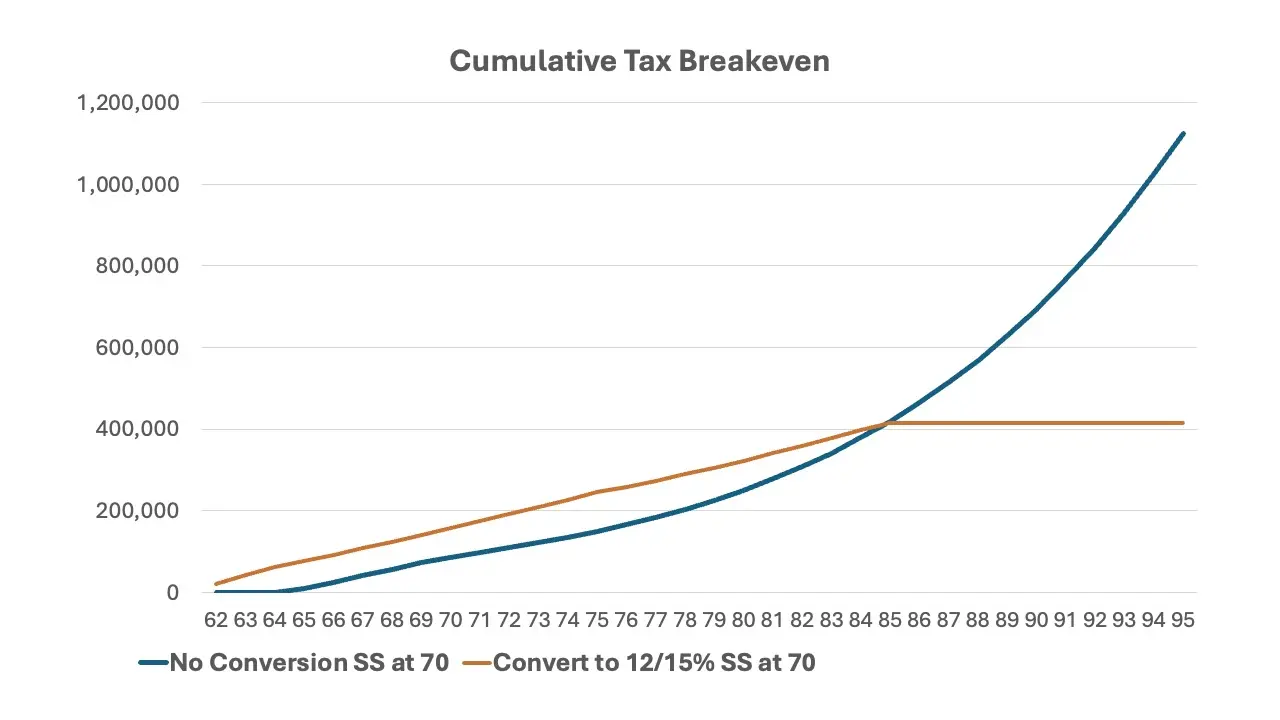

Now let’s compare that to converting up to the 12% bracket. Taxes start higher in the early years, but by around age 85, the total taxes paid break even with the “no conversion” path. After that, the Roth scenario stops adding new taxes, while the other path continues to grow. By age 95, the no-conversion path results in over $700,000 more in lifetime taxes.

So instead of just looking at the finish line, now you can see when the tax savings begin, and decide how you feel about the tradeoff of paying more now to save more later.

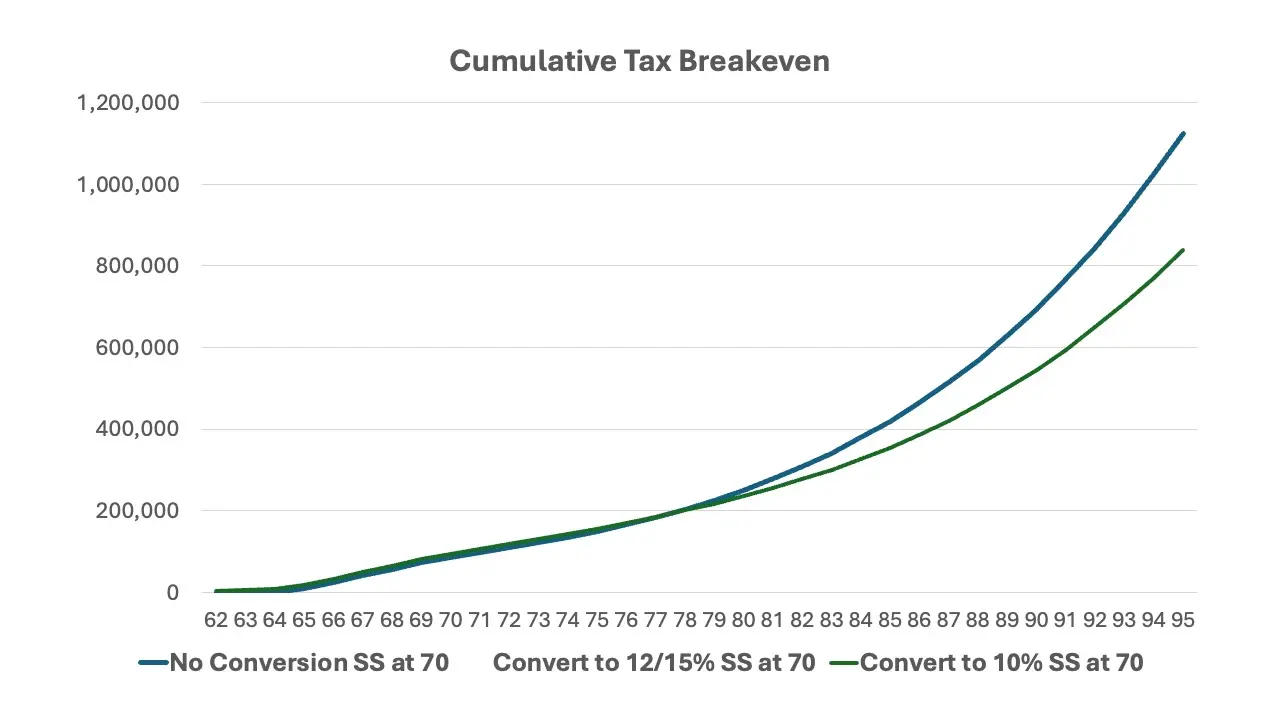

Smaller Roth Conversion Strategy

Next, let’s look at a smaller conversion amount. In this case, converting only up to the top of the 10% bracket. This shifts the break-even point much earlier, from age 85 to around age 78. You’re converting less, but by age 78, cumulative taxes break even with the no-conversion path and remain lower for the rest of retirement.

Other Cost of Roth Conversions

Now, keep in mind, so far we’ve only looked at federal taxes. If you live in a state that taxes income, be sure to factor that in as well. And don’t stop there. Larger conversions could lead you to higher Medicare premiums or trigger the Net Investment Income Tax. All of that should be included when calculating the true cost of converting.

Why This Chart Helps

I think break-even charts help reframe the Roth decision. Once you can see the timing and trajectory of taxes, it becomes much easier to make an informed choice.

Now, again, is this the only thing to consider when evaluating Roth conversions? Absolutely not. But it gives you a much clearer picture than just looking at a single year’s tax projection.

Want Help Running Your Numbers?

If you're wondering whether Roth conversions make sense in your plan, try running your numbers. Most major financial planning tools show year-by-year tax summaries, and some will even let you export those into Excel.

If you don’t want to jump through all those hoops and want to bring more clarity to your retirement, you ought to schedule a Retirement Clarity meeting with me. This is a focused conversation designed to give you insight, direction, and confidence about your financial future. You’ll get a clear picture of how we help people like you retire with purpose and peace of mind. I’ll get a better understanding of your goals, concerns, and what matters most to you. And together, we’ll see if our approach is the right fit for your retirement journey. This isn’t a sales call. It’s a conversation.

No pressure. No pitch. Just real clarity. You can schedule a time directly on my calendar using this link. Thanks for reading.