Roth Conversion Calculation: What Most Analyses Miss

Feb 02, 2026

When most people run a Roth conversion calculation, they’re trying to answer a single question: Will converting money to a Roth IRA reduce the total taxes I pay over my lifetime? That question matters, but by itself, it often leads to the wrong conclusion.

A Roth conversion decision isn’t just about your lifetime tax bill. It’s about who ultimately pays the taxes on your retirement accounts and how much of that money actually stays in your family after everyone is gone.

If your Roth conversion calculation stops when you die, it’s probably incomplete.

What a Roth Conversion Calculation Usually Gets Right

At a basic level, a Roth conversion calculation compares two paths:

-

Leave money in a traditional IRA, defer taxes, and pay them later

-

Convert some of that money to a Roth IRA, pay taxes now, and avoid taxes in the future

Most software and spreadsheets do a decent job of projecting total lifetime taxes under both scenarios. They’ll show you how accelerating income today increases taxes in the early years, and how required minimum distributions later on can push taxes higher if you don’t convert.

In many real-world plans, the result looks underwhelming.

The no-conversion scenario might show slightly lower taxes early on. The conversion scenario might catch up later, but not by much. When viewed strictly through the lens of your lifetime, Roth conversions often appear neutral or marginal at best.

That’s usually where people stop.

The Part of the Roth Conversion Calculation Most People Ignore

Traditional IRAs don’t eliminate taxes. They defer them.

And deferred taxes don’t disappear when you do.

If you die with money still in a traditional IRA, the tax bill gets passed along. First to your spouse, and then to your children or other beneficiaries. Almost always under tax rules and tax rates you don’t control.

This is where a standard Roth conversion calculation breaks down.

The Widow’s Penalty: The First Hidden Cost

If you die first, your spouse becomes a single tax filer in the following year. Single tax brackets are much less forgiving, yet required distributions don’t stop.

The result is often higher marginal tax rates on the same income. This is commonly referred to as the widow’s penalty, and it can dramatically increase taxes later in retirement even if everything looked fine while both spouses were alive.

Most Roth conversion calculations acknowledge this risk but don’t fully quantify its long-term impact.

➡️ Tip: Check out The Widow’s Tax Penalty: What Every Married Retiree Needs to Know for a deeper dive into this topic.

The Inherited IRA Problem: Where Taxes Really Explode

After your spouse is gone, your children inherit what’s left.

Under current rules, most non-spouse beneficiaries must fully empty inherited retirement accounts within ten years. Those distributions are forced taxable income, often landing right in the middle of your children’s peak earning years.

That means inherited IRA withdrawals stacked on top of:

-

Salaries

-

Bonuses

-

Business income

-

Investment income

In many cases, those dollars are taxed at 32%, 35%, or even higher rates.

The taxes you didn’t want to pay didn’t go away. They just changed hands—and frequently got larger.

A Roth Conversion Calculation With a Longer Time Horizon

Once your plan shows that you’re financially secure and likely to leave money behind, the real question changes.

Instead of asking:

“Will this conversion reduce taxes during my lifetime?”

The better question is:

“After all taxes are paid—by me, my spouse, and my children—how much of this money actually ends up in my family’s hands?”

That requires extending the Roth conversion calculation beyond your own life.

A Real-World Example

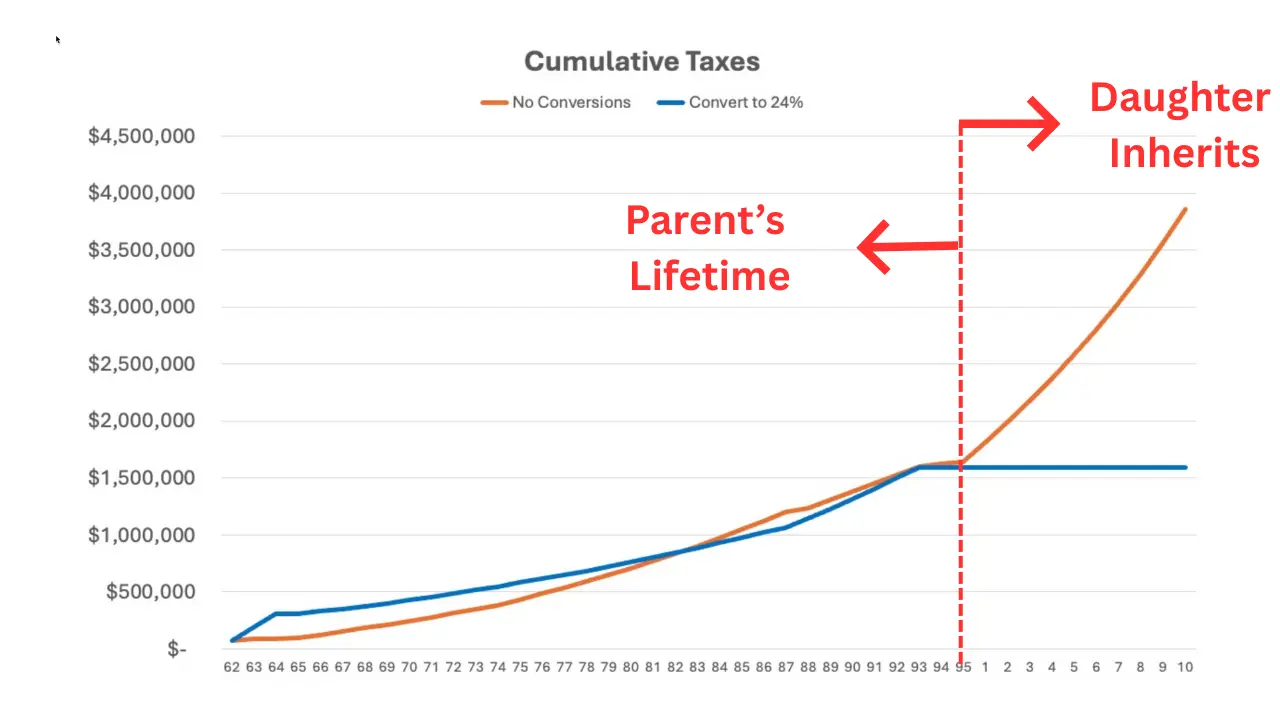

Consider a married couple with a solid retirement plan and excess assets likely to be passed on to their daughter.

When we run a Roth conversion calculation only across the parents’ lifetimes, the results are uninspiring. Converting up to the 24% tax bracket increases taxes in the early years, narrows the gap later, and never produces a dramatic win while they’re alive.

If minimizing lifetime taxes is the only goal, it’s easy to conclude that Roth conversions aren’t worth the effort.

But now extend the plan.

Both parents pass away at age 95. Their daughter inherits the remaining retirement assets and is financially successful. Every dollar she’s forced to withdraw from an inherited IRA lands in the 35% tax bracket.

Here’s what happens:

-

No conversion scenario: cumulative taxes across the family exceed $3.8 million

-

Strategic conversion scenario (up to the 24% bracket): cumulative taxes total about $1.6 million

That’s a difference of more than $2 million—not because the parents dramatically improved their own outcome, but because they prevented their daughter from inheriting a massive tax liability.

Why This Changes the Roth Conversion Decision

When the Roth conversion calculation stops at the parents’ lifetime, conversions often look neutral.

When the analysis includes the next generation, the result can be decisive.

This is why Roth conversions aren’t just a tax strategy. They’re a legacy decision.

Even a conversion that appears slightly unfavorable during your lifetime can make a lot of sense when your tax rate today is lower than your children’s likely tax rate in the future. That’s not guaranteed, but for successful dual-income households and business owners, it’s often the reality.

This Isn’t About Eliminating Taxes at All Costs

Not everyone cares about this. Some people are perfectly comfortable knowing their kids will inherit money that comes with a tax bill and still be better off financially.

Others feel strongly that they’d rather their family keep as much as possible instead of sending millions to the IRS.

In some cases, adult children even offer to help cover the tax cost of conversions because they understand what’s coming.

There’s no universal right answer.

What a Complete Roth Conversion Calculation Should Include

A good Roth conversion analysis goes far beyond a simple lifetime tax comparison. It should account for:

-

Cash flow and liquidity

-

Medicare premiums and IRMAA

-

Social Security taxation

-

Long-term care planning

-

Charitable giving strategies

-

Market returns and sequence risk

-

Future tax law uncertainty

-

Estate planning goals

-

Tax-adjusted ending balances

This example isn’t meant to suggest that everyone should convert, or that Roth conversions always reduce taxes.

It’s meant to highlight one critical point.

If your Roth conversion calculation ends when you do, you may be missing one of the most important parts of the decision.