The Widow’s Tax Penalty: What Every Married Retiree Needs to Know

May 17, 2025

When one spouse passes away, the surviving spouse often faces a painful financial surprise. Income may drop, but taxes and Medicare premiums can increase.

This is known as the widow’s tax penalty, and it's one of the most overlooked risks in retirement planning.

Understanding how and why this happens can make a big difference, especially when there is still time to prepare.

The Retirement Planning Blind Spot

Most couples plan for retirement based on the assumption that both spouses will live long, full lives. That is the foundation behind most financial plans, software projections, and Monte Carlo simulations. The focus is usually on whether the money will last for both people through decades of retirement, with little attention given to what happens if one person dies significantly earlier than expected.

But life rarely unfolds in a straight line. Health changes. Accidents happen. One spouse may pass away much sooner than anyone imagined. And when that happens, the financial picture can shift overnight.

I’ve seen this play out in my own family. My mother passed away the same year my dad retired. That definitely wasn’t part of the plan. They had spent years preparing for retirement together. But just as they were about to enjoy the life they had worked so hard to build, everything changed.

It was heartbreaking. And it was eye-opening.

That experience taught me something I had never seen in a financial plan on paper: just how fragile retirement can be when one person is left behind. It also showed me how important it is to build a plan that not only supports both people during retirement, but still works if one of them is suddenly gone.

What Is the Widow’s Tax Penalty?

The widow’s penalty is what happens when a surviving spouse ends up paying higher taxes and Medicare premiums even though their income has gone down.

Here’s why the widow’s tax penalty can hit so hard:

- One of the Social Security checks disappears.

- The surviving spouse inherits the full IRA balance and becomes responsible for Required Minimum Distributions (RMDs).

- Those RMDs are now taxed under single filer brackets, which are much less favorable than married filing jointly.

- Medicare premiums often go up, because IRMAA income thresholds are lower for single individuals than for couples.

In short: less income, higher taxes, and increased healthcare costs.

A Real-World Example: Joe and Cathy

Let's walk through a scenario.

Joe and Cathy have a combined IRA balance of $2 million. Joe receives $3,000/month in Social Security and Cathy receives $2,000/month. They rely on a combination of these benefits and IRA withdrawals to meet their goal of $9,000/month in after-tax income.

They file for Social Security at age 65 and begin taking RMDs at age 75, which provides them with more income than they actually need.

Now, let’s say Joe passes away at age 75.

Immediately, Cathy’s Social Security income drops from $60,000 per year to $36,000. That is because she now receives Joe’s higher survivor benefit, and her own benefit goes away.

However, the required minimum distribution from the IRA stays the same at $81,300. The value of the portfolio has not changed, so the withdrawal requirement does not change either.

As Cathy moves forward in retirement, her tax situation begins to shift. She is now filing as a single taxpayer, which means she is subject to less favorable tax brackets. Even though her overall income has dropped, her taxable income stays relatively close to what it was before. But now it is taxed at higher rates.

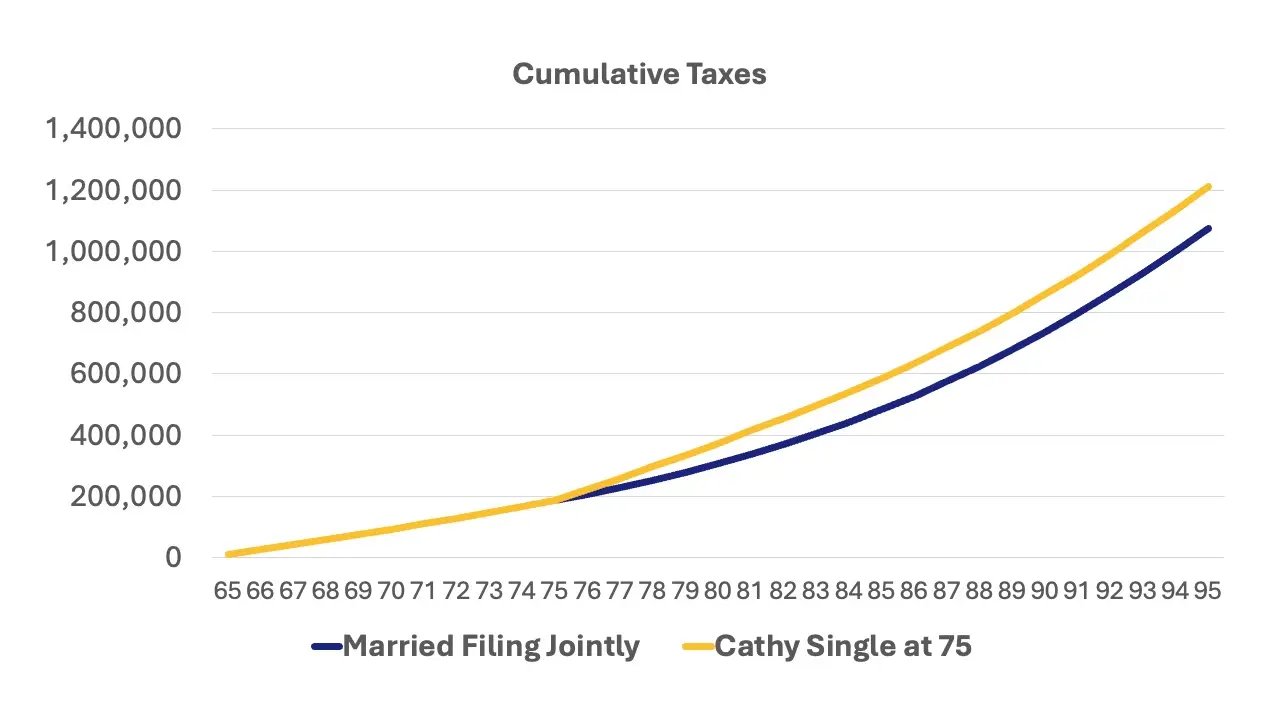

By the time Cathy reaches age 84, the difference in total taxes paid compared to the scenario where Joe was still living has grown to more than $100,000. That is the widow’s penalty in action, and it can have a lasting effect on a surviving spouse’s financial stability.

The First Year Without a Spouse

To really understand how the widow’s tax penalty takes shape, it helps to zoom in on a single year. Looking at the numbers side by side shows exactly where the financial pressure begins to build and which areas are hit the hardest.

Here is how the numbers compare:

| Category | Married Filing Jointly | Filing Single (Widow) |

|---|---|---|

| Social Security | $60,000 | $36,000 |

| RMD | $81,300 | $81,300 |

| Total Income | $132,300 | $111,900 |

| Standard Deduction | $33,200 | $17,000 |

| Taxable Income | $99,100 | $94,900 |

| Federal Tax Owed | $11,630 | $15,792 |

| After-Tax Income | $120,670 | $96,108 |

| Effective Tax Rate | 11.7% | 16.6% |

| Medicare Premium | No IRMAA | IRMAA Level 1 |

Even though Cathy’s income drops by about 20 percent, her federal tax bill increases by roughly 35 percent. On top of that, her Medicare premiums go up as well, because her income now crosses into IRMAA Level 1 territory.

This combination—lower income, higher taxes, and increased healthcare costs—is exactly what makes the widow’s penalty such a serious concern for surviving spouses.

How to Reduce the Impact of the Widow's Tax Penalty

The widow’s penalty is real, but with smart planning, you can reduce its impact. The key is to act while you’re still filing jointly, before income drops and tax brackets tighten.

1. Build Tax Diversification

If you still have a few years before retirement, this is the perfect time to start building tax diversification into your overall plan. It simply means not putting all your retirement savings into one tax category.

Many people save almost entirely in pre-tax accounts like traditional IRAs or 401(k)s. While those accounts can be great for deferring taxes while you’re working, they create a future tax burden—especially for a surviving spouse who will be filing as a single taxpayer.

Instead, aim to spread your savings across three types of accounts:

- Tax-deferred accounts (like traditional IRAs and 401(k)s)

- Roth accounts (which allow for tax-free withdrawals in retirement)

- Taxable brokerage accounts (which offer flexibility and access to favorable capital gains treatment)

Having all three gives you options to manage your taxable income in retirement. This flexibility becomes even more important if one spouse passes away. It allows the surviving spouse to draw from different buckets and potentially avoid being pushed into higher tax brackets.

2. Fill Up Lower Tax Brackets Now

If you’re in your 60s and retired but not yet drawing Social Security, this is a golden window for Roth conversions. By moving money from tax-deferred to Roth accounts at lower tax rates, you shrink future RMDs and reduce the income burden on your surviving spouse.

➡️ Tip: Watch The Hidden Tax Trap for Retirees (No One Is Talking About) to learn more about this strategy.

3. Reevaluate Your Social Security Strategy

I’m not someone who automatically tells everyone to delay claiming Social Security. It really depends on your overall plan, your cash flow needs, and your long-term goals. But if your priority is to protect your spouse financially after you are gone, delaying your benefit can be a smart move.

The survivor benefit is based on the higher earner’s Social Security amount. By waiting to claim, you increase that benefit. If something happens to you, your spouse will receive a larger monthly check for the rest of their life. That extra income can be especially helpful at a time when household income has dropped, taxes may have gone up, and healthcare costs have increased.

4. Use Qualified Charitable Distributions (QCDs)

If charitable giving is part of your retirement plan, Qualified Charitable Distributions can be a tax-smart way to do it. Starting at age 70½, you can give directly from your IRA to a qualified charity. The amount you give can count toward your Required Minimum Distribution, but it is not included in your taxable income.

This strategy can lower your overall tax bill and help you avoid pushing your income into a higher tax bracket or triggering higher Medicare premiums.

A lot of retirees give regularly to their church, a local nonprofit, or another cause they care about. But many do not realize they could be doing it in a way that also benefits their tax situation. If you are already giving, or plan to, this is a strategy worth understanding. It is simple, effective, and often overlooked.

➡️ Tip: Check out The Smart Retiree’s Guide to Qualified Charitable Distributions for a step-by-step breakdown.

Planning for the Spouse Who Might Outlive You

Planning for the widow’s tax penalty is not about expecting the worst. It is about being ready for whatever life brings. A solid retirement plan should do more than cover both lifetimes. It should also adapt and continue to support the one who may be left behind.

Taking a few proactive steps now can save your family thousands of dollars in future taxes and healthcare costs. Just as important, it can give your spouse lasting financial stability and peace of mind.

If you want help building a plan that accounts for this, I’d be happy to talk. Whether you are a few years away from retirement or already in it, there are ways to plan smarter, reduce tax burdens, and protect the people you care about most.