Roth Conversions Have Changed: How the OBBA Made Roth Conversions More Attractive for Retirees with Large IRAs

Jul 11, 2025

When the One Big Beautiful Bill Act became law, most of the headlines focused on what didn’t happen. The 2017 tax cuts, often called the Trump tax cuts, didn’t expire. The tax brackets didn’t go up in 2026 as originally planned. For many retirees, that was welcome news. But there’s another part of the story that isn’t being talked about enough, and it might matter even more especially if you have a large traditional IRA and are considering Roth conversions.

The brackets didn’t just stay at their current percentages. The amount of income allowed within each bracket also stayed the same. That quiet detail changes the math in a big way.

Let’s say you’ve been converting a portion of your IRA each year. Under the old law, many of the brackets would have narrowed starting in 2026. You would have had less room to convert at your target tax rate before spilling over into a higher one. But now, with the structure of the brackets locked in, you have more space to convert at rates that many still consider reasonable.

That opens the door to larger, more strategic conversions over time. For retirees who are delaying Social Security, drawing from cash or taxable accounts, or sitting on a large pre-tax balance, this change could reduce future RMDs, lower long-term taxes, and build a bigger pool of tax-free income for the years ahead.

Let's walk through what actually changed and how this extension may impact your retirement tax strategy. I’ll also share a real case study showing how one couple is using this moment to reduce lifetime taxes and create a more efficient withdrawal plan.

But before we get into the case study, it helps to understand just how much the brackets would have changed if the law had expired.

How Much the Brackets Would Have Changed

The tax brackets were not just preserved in name. The actual income ranges within each bracket were scheduled to shrink in 2026. That part rarely made the headlines, but it would have changed the math for anyone using Roth conversions as part of their retirement plan.

When the 2017 tax cuts were first passed, they didn’t just lower tax rates. They also widened the brackets. That change gave retirees more room to convert IRA dollars at manageable rates. But if the tax cuts had expired, the brackets would have reverted to their older, narrower structure. And that would have meant less room to work with each year.

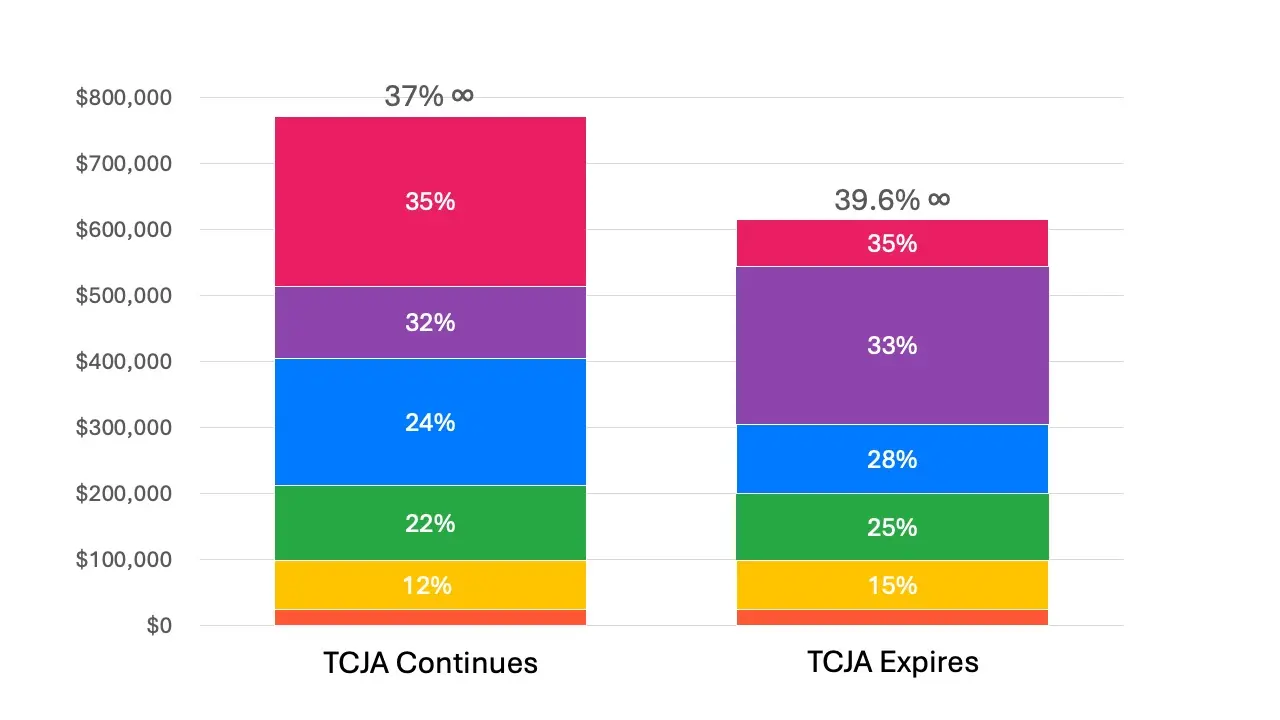

Here is a comparison of the current tax brackets versus what they would have looked like under the old system:

One of the most important differences is in the middle of the tax table. Under today’s brackets, income up to $405,049 is taxed at no more than 24 percent. But if the tax cuts had expired, that same amount of income would not have stayed in that range. Much of it would have spilled into the 28 percent bracket, and some would have gone even higher into the 33 percent bracket. That shift in bracket exposure would have increased the tax cost significantly for retirees doing larger conversions.

For anyone managing income carefully in retirement, including those trying to reduce future RMDs or leave more tax-free assets to heirs, having access to wider and flatter brackets makes a real difference. Now that those brackets have been extended, the opportunity to convert strategically is still available. The best way to see how much that matters is through a real-world example.

Case Study: The Same Roth Conversion, Two Very Different Tax Outcomes

Let’s take a look at how the extension of the 2017 tax cuts has changed the math on Roth conversions for a typical retired couple who have been good savers.

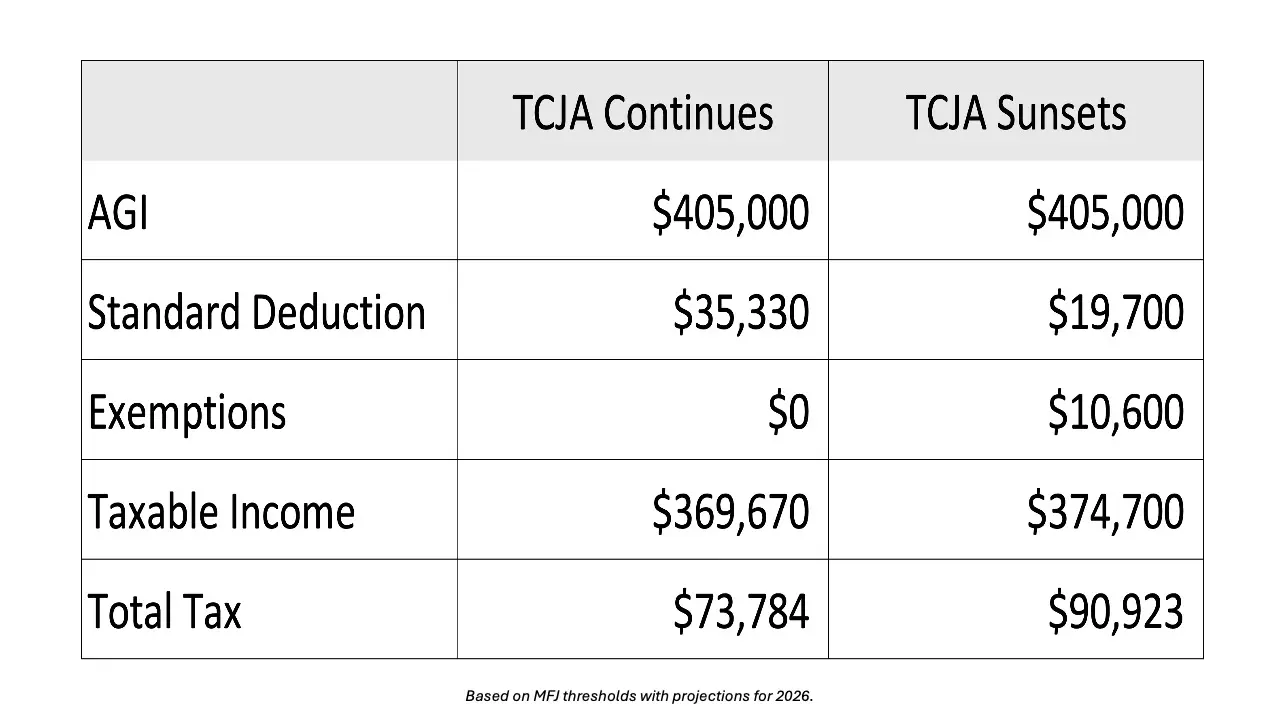

This couple is both age 65 and no longer working. Their annual income includes $10,000 in interest, $10,000 in dividends, $50,000 in IRA distributions to cover living expenses, and $60,000 in combined Social Security benefits. They’ve also decided to convert additional IRA dollars to Roth, bringing their total income up to the top of the 24% bracket under the TCJA brackets.

For comparison, we modeled two scenarios using the exact same conversion amount:

-

One where the Trump tax cuts continue (as they now do under the OBBA),

-

And one where the tax cuts expired in 2026, reverting to pre-TCJA law.

Here’s how their tax return looks in 2026 under both versions of the law:

Despite having the exact same income and the same Roth conversion amount, the couple pays over $17,000 more in federal taxes if the tax cuts had expired. And that’s just for one year.

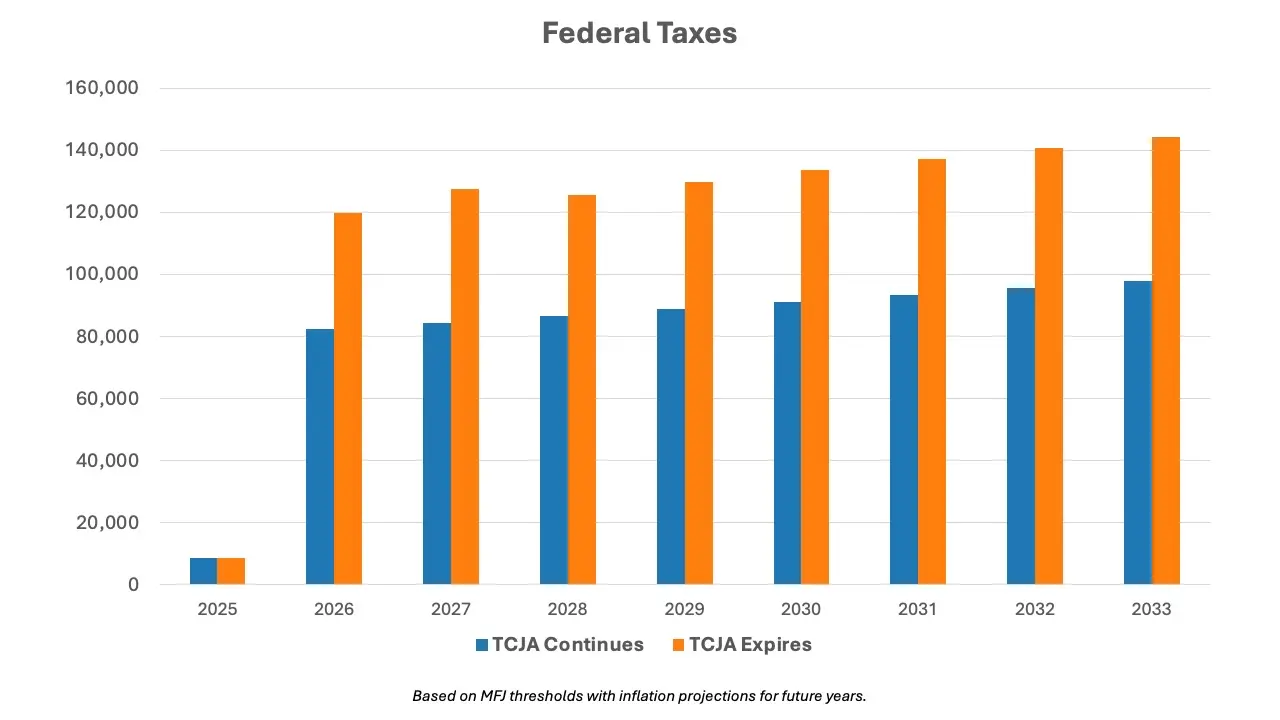

Now let’s zoom out and look at what happens over time. Below is a chart comparing the couple’s projected annual tax cost if they follow the same Roth conversion strategy every year from 2025 to 2033.

In every single year after 2025, the tax cost of doing conversions under the old, higher bracket structure would have been significantly greater. By 2033, the difference in annual tax cost reaches over $46,000. When you’re executing a multi-year conversion strategy, that adds up quickly.

If we take it one step further and look at the cumulative tax paid over time, the results are even more dramatic. By 2033, the couple would have paid $338,309 more in total federal tax if the tax cuts had expired. And by the end of their plan in 2044, the total difference crosses $350,000.

This is not a case of doing something differently. This is a case of doing the same thing, but under a different tax structure. And the result is hundreds of thousands of dollars in potential tax savings.

This is not a case of doing something differently. This is a case of doing the same thing, but under a different tax structure. And the result is hundreds of thousands of dollars in potential tax savings.

For retirees sitting on large traditional IRA balances and converting each year to reduce their future RMDs, lower IRMAA exposure, and shift assets to tax-free Roth accounts, this change makes a big difference. More income now fits within the lower tax brackets. And that creates more room to convert, more predictability in planning, and a better chance of avoiding tax surprises down the road.

Your Retirement Plan Is Now Wrong

Most financial plans created over the past few years, whether built with an advisor, a software tool, or a spreadsheet, included one key assumption. The 2017 tax cuts were set to expire in 2026. That was not a guess. It was written into the law. Even the projections we created for our own clients reflected that assumption, because it was the most accurate information available at the time. (Thankfully, reviewing and updating tax assumptions is already part of our annual client service process, and each of those plans will be updated to reflect the current law.)

But something changed. Congress stepped in and extended the tax cuts. The brackets did not shrink. They stayed wide. For many retirees, that decision created an opportunity to save thousands, and in some cases, hundreds of thousands of dollars over the course of retirement.

The challenge is that most plans have not been updated. The assumptions changed, but the math may still be based on the old rules. If you have a large traditional IRA, this is the right time to revisit your plan and re-run your conversion strategy using the tax code as it stands today, not as we once expected it to be. Even a small difference in your assumptions can lead to a much larger change in your outcome.

If we can help, don't hesitate to get in touch.