How Much Should You Convert to Roth? Finding Your Personal Sweet Spot

May 20, 2025

Choosing to convert to Roth could be one of the most impactful moves you make in your retirement income strategy. But like any powerful tool, a Roth conversion can become costly, or even counterproductive, if used without a clear strategy and the right background knowledge. Converting too little might mean missing out on future tax-free growth, while converting too much can lead to paying taxes you didn’t need to.

The key is finding the right balance. It’s not just about staying under the next tax bracket or avoiding IRMAA surcharges. That approach works well for answering the question: How much should I convert this year? But it doesn’t tackle a bigger and often more important question: How much should I convert in total?

Should you aim to convert everything in your traditional IRA, or is there a smart reason to leave some money in pretax accounts?

The good news is, you don’t need complex math to find the right answer. With a little background knowledge and a clear framework, you can start making confident decisions that align with your long-term goals.

For this guide, we’ll assume you’ve already decided to move forward with Roth conversions. You’ve also chosen to manage your conversions year by year using a bracket-based approach that considers federal tax thresholds and/or Medicare IRMAA limits.

That leads to the real question: How do you know when you’ve converted enough?

This is where things can get tricky, but the good news is, there are a few reliable guideposts that can help you land on the right number. The goal is to find your optimal conversion amount—not too much, not too little.

Here are three key factors I always walk through when helping someone decide how much of their IRA to convert. Together, they form a practical framework for identifying your personal Roth conversion sweet spot.

1. Preserve Your Tax-Free Withdrawal Space

The first thing to consider when deciding how much to convert to Roth is this: don’t convert so much that your future adjusted gross income (AGI) ends up lower than the standard deduction.

Here’s why that matters.

The standard deduction acts as a tax-free zone. It’s the portion of your income that the IRS doesn’t tax. When your taxable income falls below this level, you owe zero federal income tax on that portion of your withdrawals.

Let’s look at how this works:

- You start with your total income

- Subtract eligible adjustments (like HSA contributions or IRA deductions)

- That gives you your Adjusted Gross Income (AGI)

- Then you subtract the standard deduction

- The result is your taxable income

So if your future AGI falls below the standard deduction, it means you had room to withdraw income tax-free. But if you already converted that income to Roth and paid tax on it, you missed that opportunity.

In other words, you paid taxes today on income you could have withdrawn tax-free later.

Why Future AGI Matters

To make a smart long-term Roth conversion plan, you need to project two things:

- What your income will likely look like in retirement

- What the standard deduction will be in those years

That second piece is tricky, because the standard deduction could change. The Tax Cuts and Jobs Act (often referred to as the Trump tax cuts) is scheduled to expire at the end of 2025. If that happens, the standard deduction will shrink, but personal exemptions may return. If the tax cuts are extended—or made permanent—the current higher standard deduction could remain.

Visualizing the Risk of Overconverting

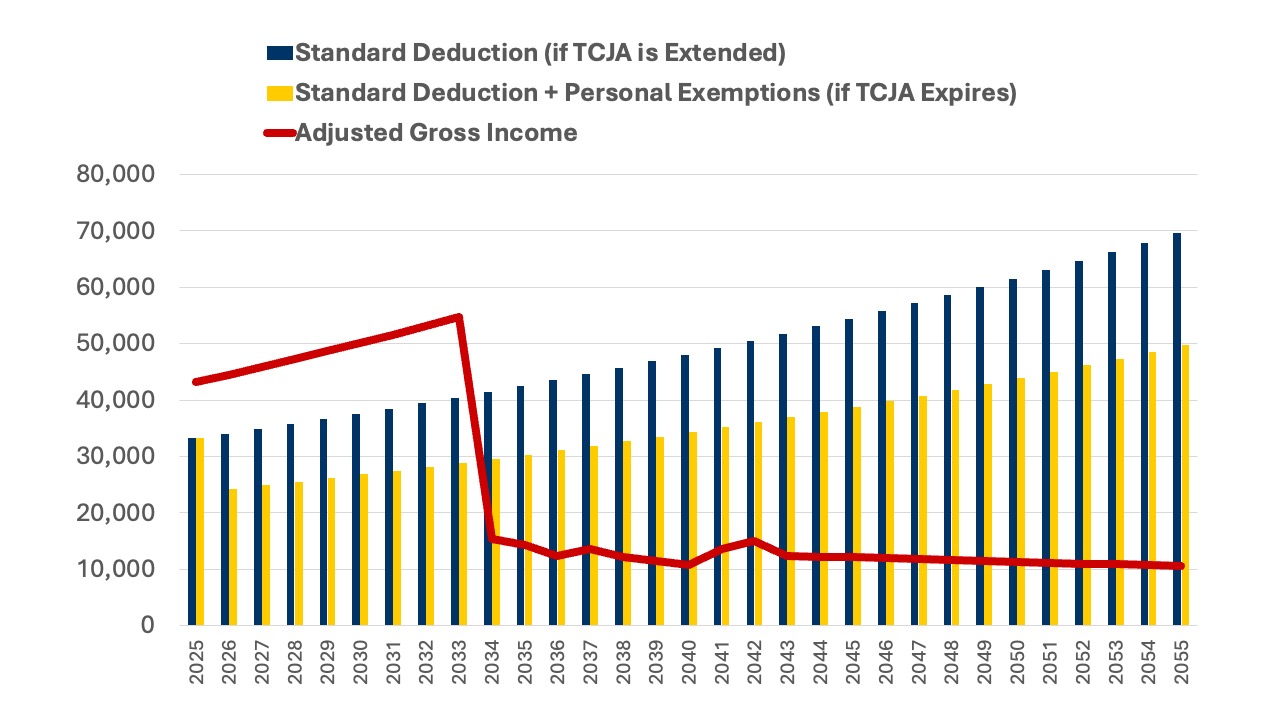

Take a look at the chart below. The blue bars show the projected standard deduction for a married couple filing jointly, assuming the current tax law is extended. The gold bars represent what the deduction might look like if the tax cuts expire and personal exemptions are restored. The red line represents a couple’s projected AGI.

The key takeaway: you don’t want your AGI (the red line) to fall below either version of the standard deduction (the bars). That gap represents income you could have taken from your traditional IRA without owing taxes.

A Real Example: The Year 2040

Zooming in on the year 2040, the chart shows that:

- If tax cuts expire, a couple would leave about $24,000 in tax-free space unused

- If tax cuts are extended, they’d miss out on about $38,000 in tax-free withdrawals

In either case, converting more than necessary in earlier years would have led to an unnecessary tax bill. That’s why it’s critical to keep an eye on future AGI levels and not just focus on what you can convert today.

The bottom line is, don’t convert so much that your future income falls below the standard deduction. It’s not just about what you can afford to convert—it’s about making the most of your future tax-free withdrawal space.

2) Save Your IRA for Charitable Giving

The second factor to consider when deciding how much to convert to Roth is charitable giving. Specifically, you want to leave enough in your pretax IRA to fund future gifts through Qualified Charitable Distributions (QCDs).

A QCD allows you to donate directly from a traditional IRA to a qualified charity once you reach age 70½. These donations count toward your Required Minimum Distribution (RMD), but here’s the real advantage: QCDs are excluded from your taxable income altogether. Unlike a typical charitable deduction, this income never even shows up on your tax return.

Let’s say you give $10,000 a year to charity. There’s a strong case for not converting your entire IRA to Roth. Why? Because if you keep enough in your traditional IRA to fund that giving, you can make those donations tax-free through QCDs—without needing to itemize.

But if you had already converted those dollars to Roth, you would have paid tax on them upfront. That means you lose the opportunity to give those funds away tax-free later. And if you try to make the same gifts from your Roth or a taxable account, you might not get a full deduction, especially if you’re taking the standard deduction like most retirees.

This builds on the previous strategy we discussed. If your AGI drops below the standard deduction, you lose the chance to take tax-free withdrawals. But if you also plan to give through QCDs, your true tax-free zone becomes even larger: the standard deduction plus your annual charitable giving.

In the $10,000 giving example, that means keeping your AGI high enough to support tax-free withdrawals and QCDs without triggering taxes or losing deductions.

3. Keep a Pretax Reserve for Long-Term Care

The third factor to consider when deciding how much of your pretax IRA to convert is the potential cost of long-term care. This is one of the most overlooked areas in Roth conversion planning, but it can have a major impact on your tax outcome - especially later in life.

Here’s why it matters.

If your unreimbursed medical expenses exceed 7.5% of your adjusted gross income (AGI) in any given year, the amount above that threshold becomes a tax deduction. This includes a wide range of medically necessary services like:

- Home health aides

- Assisted living

- Skilled nursing care

- Memory care or long-term nursing facilities

If you still have money in your traditional IRA when those expenses arise, you may be able to withdraw the funds and offset some or all of the tax with the deduction from your medical expenses. But if you already converted everything to Roth, that opportunity is gone. The income doesn’t exist anymore, so there’s nothing to deduct against the expense.

That’s why we recommend leaving a portion of your pretax IRA intact as a flexible reserve. You may never need it, but if you do it could save you a significant amount in taxes.

Think of it as a safety valve. If you face high medical costs in one year, that traditional IRA can be tapped in a way that minimizes or eliminates the tax impact.

How Much Should You Set Aside?

One of the best tools for estimating this is the CareScout Cost of Care Survey, which provides cost breakdowns for different types of care across various locations. To estimate how much to leave in your pretax IRA:

- Look up the average cost of care in your area

- Multiply that by the number of years you want to plan for (two years is a common baseline)

Example: If care in your area averages $90,000 per year, setting aside $180,000 in your traditional IRA would cover two years of potential long-term care costs.

If you end up needing care, those dollars are there—and potentially very tax-efficient. If you don’t need them, the funds can still be used for RMDs or passed to heirs.

Finding YOUR Conversion Strategy

The total amount you choose to convert is one of the most important tax decisions you'll make in retirement. As we’ve seen, this isn’t an all-or-nothing choice. The goal isn’t to convert everything, and it’s certainly not to do nothing. The real value lies in finding that personal sweet spot where you reduce your future tax burden without giving up valuable tax-free opportunities.

Getting to that sweet spot takes a combination of math, foresight, and a clear understanding of your goals. It also takes knowing what not to do: avoid overconverting below the standard deduction, don’t miss the chance to give through Qualified Charitable Distributions (QCDs), and keep some pretax funds available for potential long-term care costs.

Of course, not every retiree will take the standard deduction. Some will itemize, especially in high-property-tax states or if they’re making large charitable gifts. And none of us can predict the future with certainty—whether that’s changes in tax law, health needs, or spending patterns.

But that doesn’t mean we plan blindly.

By keeping these three principles in mind, you create a flexible, forward-looking framework. It helps you convert to Roth with confidence, knowing you're not just managing taxes today, but also setting yourself up for greater control and efficiency in the years to come.

You don’t need to predict everything perfectly. You just need a strategy that fits your life.

There is a Roth conversion amount that’s just right for you. When you get that dialed in, you gain clarity, confidence, and greater peace of mind throughout retirement.

If you’re wondering how much of your IRA to convert—and when—you don’t have to figure it out alone. This is exactly the kind of planning I help people with every day. Schedule a time to talk and let’s find your Roth conversion sweet spot, so you’re not overpaying taxes now or missing opportunities later.