The Hidden Taxes in Retirement (No One Is Talking About)

May 01, 2025

What if the very thing you trust most to protect your retirement is secretly setting you up for a crushing tax bill?

We’ve all been taught to use conservative assumptions when planning for retirement, especially when it comes to investment returns. And that’s not a bad instinct. After all, the number-one question on most retirees’ minds is:

“Will I run out of money?”

But here’s the problem: Traditional retirement plans often stop there. They focus on avoiding disaster, without fully considering what happens if things go better than expected. And when it comes to taxes, that oversight can cost you dearly.

The IRS Doesn’t Care About Your Taxes in Retirement

The IRS doesn’t care how cautious your plan is. It doesn’t care how much income you actually need in retirement.

Once you hit the age for Required Minimum Distributions (RMDs), you’re forced to start pulling money out of your pre-tax accounts—whether you need it or not. For many retirees, pre-tax accounts make up 70% or more of their portfolio.

So even if your portfolio has grown at a moderate pace (say, 6–8% per year), you could find yourself with far more taxable income than you ever planned for.

In other words, the problem you spent your whole financial life avoiding—running out of money—might never materialize. Instead, you could face a different threat: being taxed on a flood of income you don’t need.

💡 Key Insight: The IRS doesn’t care how much income you need—only how much you must withdraw. That’s why even a conservative plan can create a surprise tax bill.

Why Most Retirement Plans Ignore Taxes in Retirement

Most financial plans only test for downside risk. They run hundreds or thousands of simulations asking:

“What if the market underperforms?”

“What if I live longer than expected?”

That’s important, but it’s not enough. Because if your plan doesn’t account for success (what happens if things go better than expected), you may walk straight into a tax trap.

A Real Example: Hidden Taxes in Retirement That Can Sneak Up

Let’s look at a sample couple, age 63, who just retired. As you read this, think about how their situation compares to yours.

- $400,000 in a joint taxable account

- $2.1 million in pre-tax IRAs

- Social Security: One spouse at $3,300/month, the other at $1,850/month

- Spending need: $9,000/month after taxes, with inflation adjustments

Their spending plan follows common retirement data, with slight spending reductions around ages 80 and 90. We’ll exclude long-term care for simplicity.

Here’s what happens under three different return scenarios:

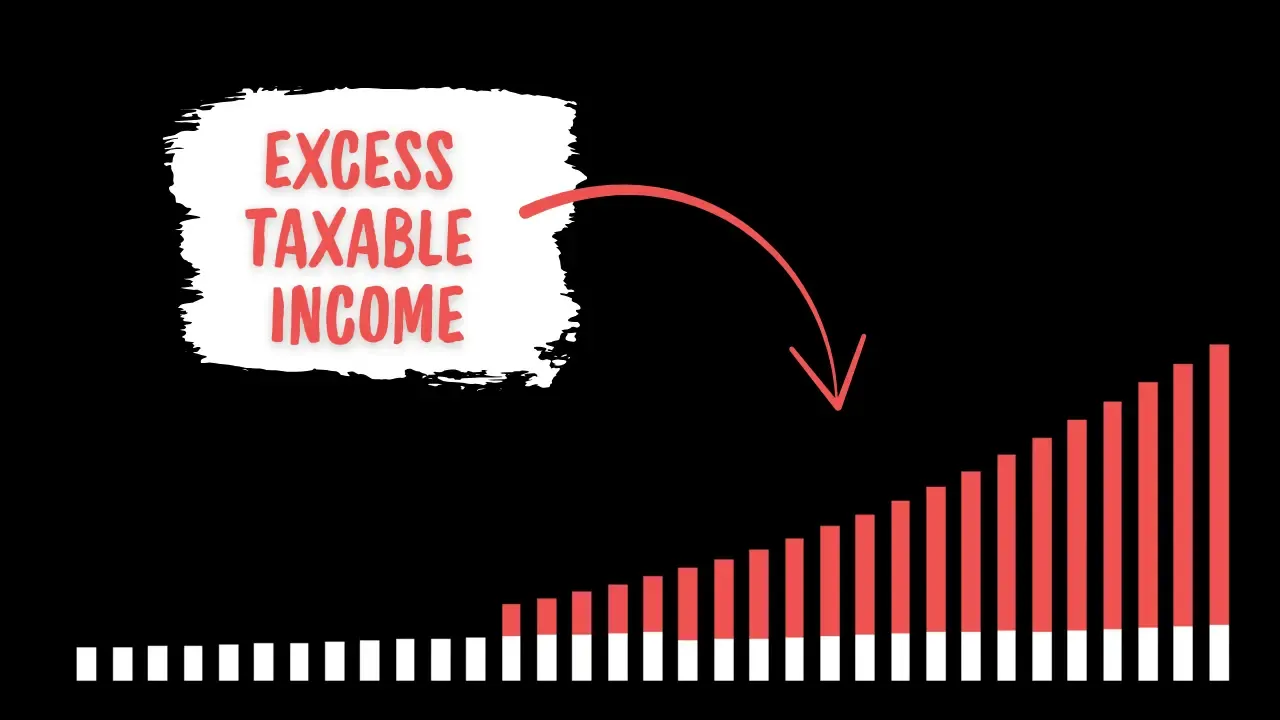

At 4% average return: Taxable income stays fairly tame, about $62,000 higher than their actual income need by age 80. There’s a gap, but it’s not overwhelming.

At 6% average return: Now taxable income jumps to over $115,000 above what they need by age 80. The tax inefficiency is becoming clear.

At 8% average return: By age 80, taxable income soars to over $230,000 above their income need. This is no longer a mild tax issue—it’s a full-blown tax avalanche.

📊 Did You Know? For many retirees, pre-tax accounts make up 70% or more of their total portfolio. That’s why Required Minimum Distributions can trigger such a big tax shock.

Why This Happens to Taxes in Retirement

The plan was built to be “safe,” but it only tested for failure. It never asked:

- “What if we get average or above-average returns?”

- “What if the market cooperates?”

The result? Huge IRA balances by the time RMDs hit, and a tax burden that could have been avoided with proactive planning.

⚠️ Common Mistake: Many retirement plans only test for bad markets or long lifespans. They rarely ask, “What if my investments do well?” That can leave you exposed to avoidable taxes.

The Critical Window to Reduce Taxes in Retirement

If this couple could go back, they’d likely jump at the chance to take action in their early retirement years, when their taxable income was still low.

Strategies like Roth conversions or adjusted withdrawal strategies could have dramatically reduced their future tax bill. But once RMDs hit, the window to fix it largely closes, leaving them with few options other than writing big checks to the IRS.

If you’re in your early retirement years, this is your chance to act while taxes are still under control.

🚀 Take Action Early: The first years of retirement are your window to act. Consider Roth conversions or withdrawal strategies before RMDs start.

How to Avoid a Massive Tax Trap in Retirement

The good news? You don’t need a crystal ball.

You just need to recognize that the early years of retirement are your window of opportunity. Before RMDs begin, you have the most control over your tax future.

A little planning now, whether through Roth conversions, withdrawals, or other tax strategies, can save you tens of thousands in taxes down the road.

The Bottom Line: A Smarter Plan for Taxes in Retirement

Retirement success isn’t just about not running out of money. It’s about building a plan that works across all scenarios—including the good ones.

If you’re within a few years of retirement, or already retired, this is the time to ask:

- Are you missing opportunities to reduce taxes while rates are still low?

- Is your plan prepared for the day RMDs force income on you that you don’t actually need?

If you’re not sure, we can help. We specialize in helping retirees build tax-efficient retirement income plans that prepare for both the risks and the opportunities ahead.

Are you ready to make sure your plan is set up for success? Let’s talk.

✅ Ready to Take Control? Let’s make sure your retirement plan works in good times and bad—without surprise tax bills. Schedule your free Retirement Clarity meeting today.