Our Blog

You can do everything “right” on paper. Save diligently. Invest responsibly. Retire with more than enough money.

And still have your retirement quietly undermined by a few loose ends.

These aren’t d...

When most people run a Roth conversion calculation, they’re trying to answer a single question: Will converting money to a Roth IRA reduce the total taxes I pay over my lifetime? That question matters...

There’s a powerful retirement planning opportunity that I see many retirees miss.

It’s not a secret investment strategy. It’s not a loophole. And it has nothing to do with trying to beat the market.

...When I first started creating content and discussing Social Security, many of my colleagues were skeptical. Some even asked, “Why are you focusing so much on this? Wealthy people don’t worry about So...

You might think that if you’ve got a million or two saved for retirement, or maybe a lot more, the worries around retirement income would disappear. But in my experience, that’s not how it works.

...Roth conversions can be a smart move in your retirement income plan, but if you’re not careful, you can go too far and end up paying taxes you didn’t have to.

Most people think the only question is: ...

There’s one chart you need to see if you’re thinking about a Roth conversion. It shows you when the taxes you’ve paid finally start saving you money.

It’s called the break-even point. And if you have...

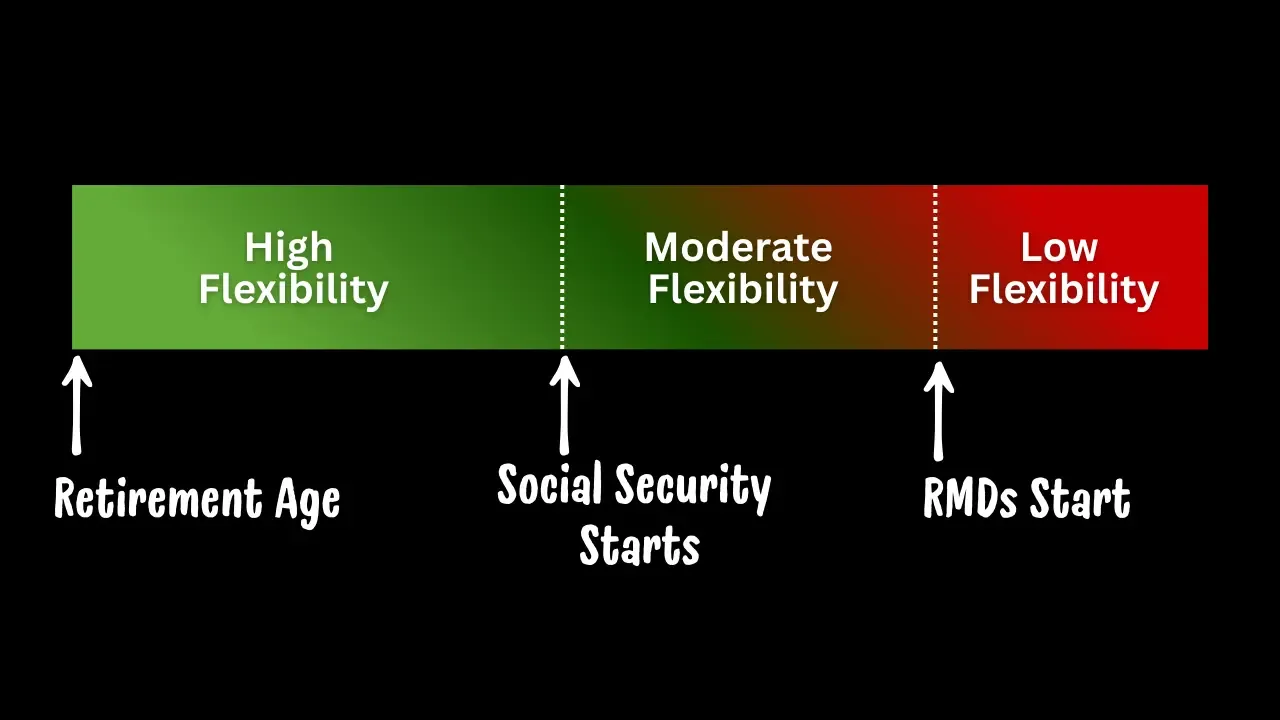

When you're working, taxes usually feel pretty straightforward. You earn a paycheck, and that paycheck gets taxed as ordinary income. That’s it.

Once you retire, things get more complicated.

Your in...

You have probably heard it before: “Delaying Social Security gives you an 8% guaranteed return.” It sounds incredible in a world where most retirees are balancing market risk, rising costs, and uncert...

Your retirement plan is only as strong as your budget, and that’s why a Retirement Budget Calculator is essential. If you retire without a clear, data-driven way to estimate your monthly spending need...

If you’re looking for a financial advisor in Texarkana, Texas, Carroll Advisory Group is here to help. Our CFP® team specializes in retirement planning, investment management, and tax strategies desig...

Below you’ll find answers to the most common questions about Health Savings Accounts (HSAs). Click a section to jump directly to what you’re looking for.

Jump to a Section

- HSA Basics

- HSA Co...